This week I am going to discuss Accountability. I feel that understanding accountability is very important for succeeding in life. My grandfather told me that I have to be accountable for my actions and words when I was about 10 years old. I have tried to be true to that principle throughout my life.

After he passed away, a few years later, I figured out another lesson…that you should not rely on anyone else to guarantee your success.

The expectation was that we would all, (the grandchildren), continue in the family seafood business. I soon realized that I couldn’t depend on people’s promises to get ahead. That if I wanted something, I had to make it happen myself.

Because of my decision to take control of our future in the last few years, I started a journey of self-improvement. I have learned a good bit and implemented many of the things I have learned. Some things I was already doing, others were revelations. Below is a brief, non-exhaustive summary of what I have learned.

|

| Be Accountable to Yourself! |

Decide to Change

Nothing you want to change will change until you decide to change it. Griping and complaining about how bad a situation is will do nothing about it. Saying you will change or want to change will do nothing about it. Until. You. DECIDE. To. CHANGE.

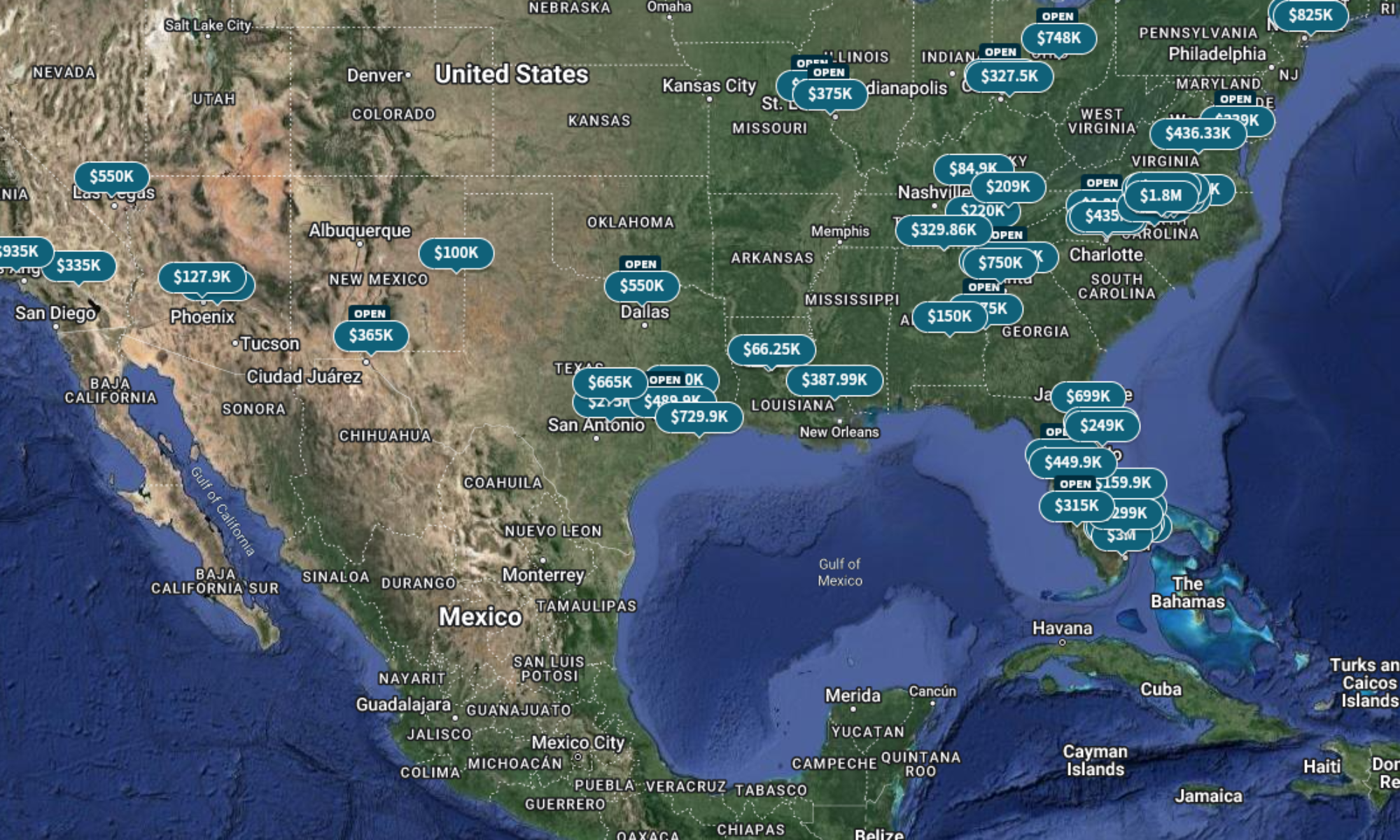

Set Goals

Set goals you want to achieve. Things you want to accomplish. Places to visit. There are a couple of different ways to approach this. One is to take the bucket list approach. Detail everything you want to do. Tim Ferris suggests writing daily goals on a quarter-folded sheet of paper. This way, the list stays small and achievable. Whatever approach you take, remember this:

“Alice: Would you tell me, please, which way I ought to go from here?

The Cheshire Cat: That depends a good deal on where you want to get to.

Alice: I don’t much care where.

The Cheshire Cat: Then it doesn’t much matter which way you go.

Alice: …So long as I get somewhere.

The Cheshire Cat: Oh, you’re sure to do that, if only you walk long enough.”

Based on the above, unless you have a goal, you can’t really direct what you are doing. Which leads us to the next step…

Make a Plan

Once you have your goals in place, put together a plan on how to achieve them. Figure out what you will need to do, in the most efficient order you can think of. Try to mitigate risk by thinking of all the bad things that could happen along the way and have a plan for dealing with them.

Find an Accountability Partner

A lot of advice I have run across recommend having an accountability partner. Someone to express your goals to, review them on a regular basis, and help to keep you on track to succeed.

Grow! Achieve! Succeed!

All that is left to do now is to proceed…OK, it’s not that easy, but, the thing to remember is that you will run into setbacks. Things will go sideways every once in a while. Do not let that discourage you. Keep pushing forward and be the YOU you want to be. Like Mike Tyson said, “Everybody has a plan until they get punched in the face.” Learn to be resilient. Take responsibility and move forward, ever forward.

|

| http://www.thatonerule.com/ |

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.