Merry Christmas! Happy Holidays! Happy Solstice! Happy Hanukkah! Joyous Kwanzaa! Yuletide Greetings! Joyeux Noël! Feliz Navidad! Season’s Greetings! Happy New Year! Joy! Celebrate! Be Merry! And most of all, wishing all of you who read this a new year full of peace and joy!

I’m sitting here between Christmas and New Year’s Day contemplating the future. To paraphrase Game of Thrones, “Change is Coming”.

As many of you know, we decided to start investing in real estate as a buffer to the ups and downs of my chosen industry, Oil and Gas Exploration. I was able to make it through some of those ups and downs in the past, maybe by luck, or because what I was working on was important. At one point, I did take a demotion and worked in the field (offshore, on the rigs, for about a year, but was able to move out of that role and on to greater things.

Which brings us to current times. Things have dipped again.

I usually take the last two to three weeks of the year off since I usually don’t use all of my vacation throughout the year. I was sitting at home and my supervisor called and asked if I was at the office. Since I wasn’t, he asked if I could come in. This told me that something was up because his office is over 100 miles away and if he is at my office, then it must be my turn.

And it was, but with a twist. I was offered a choice between an early retirement package or a rotational position working in Houston.

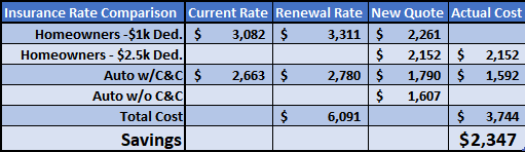

My darling wife and I contemplated the choices for a couple of days. Ultimately, we decided that it would be best to take the position in Houston. While we would be OK with me not working for a while, ultimately, it was our need of medical insurance that swayed our decision. Speaking of medical insurance, my next article will cover my experience in trying to get a quote for it and the fraud potential inherent in the Louisiana Medicaid Program.

Working a rotational job in Houston would mean finding a place to stay when working and time away from the family, but it also would mean that for two weeks out of every four, I would be off of work and free to do as I please.

This should allow for catching up on projects around the house and more opportunity to generate passive income.

The down side is that I will not be in town for some of the Bayou Real Estate Investor Networking meetings. I will continue to organize them, but will have to rely on other members to host when I cannot attend.

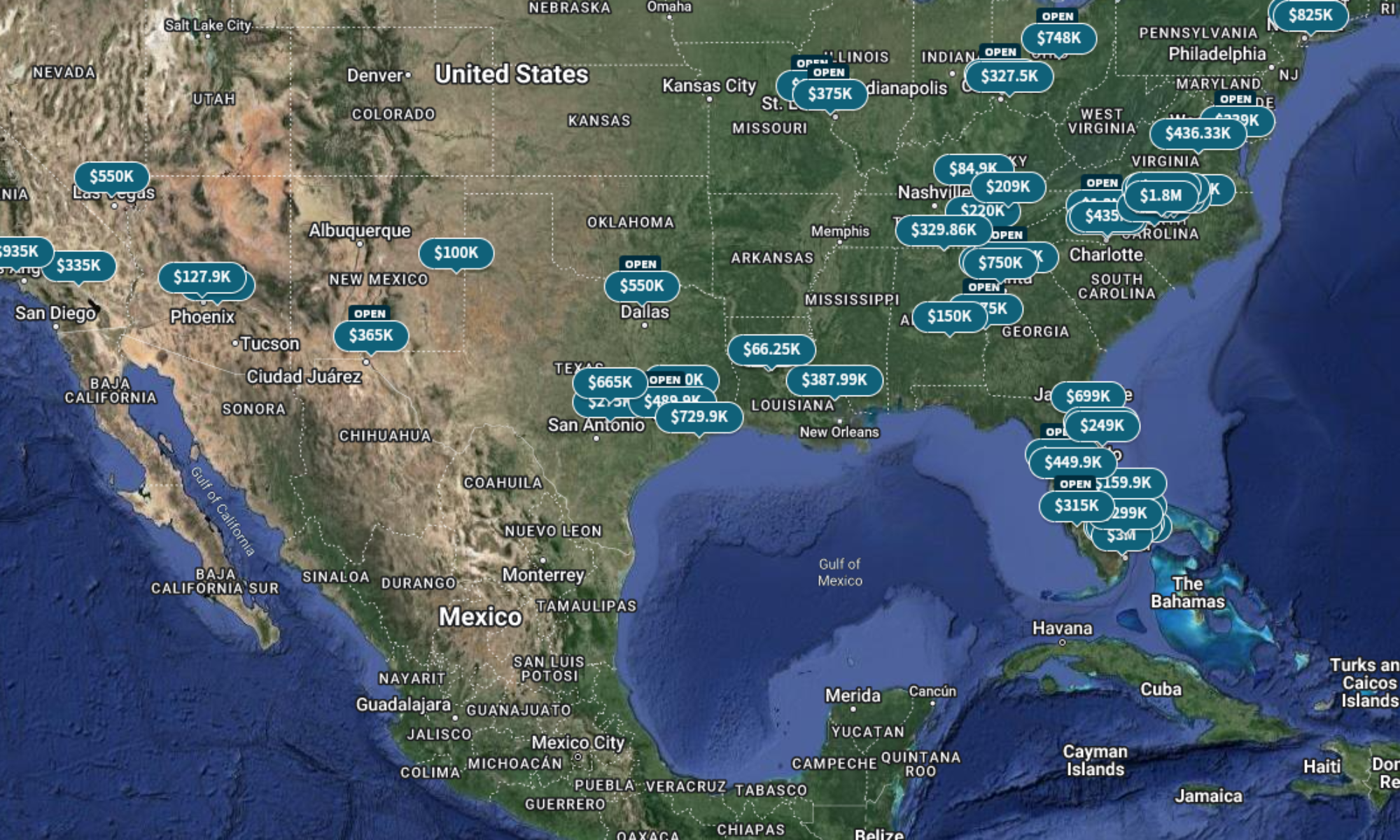

Additionally, if any of you live in or around North Houston / Humble / Kingwood and know of decent rentals at a good price, please contact me!

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.