|

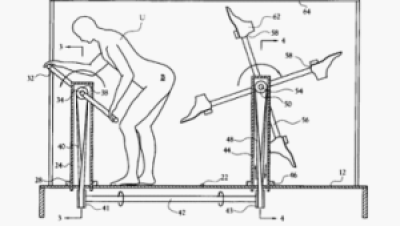

| Image from US Patent #6,293,874…”User-operated amusement apparatus for kicking the user’s buttocks” |

Today I am going to cover some things that we experienced last year while rehabbing a house acquired to become a rental.

This was our first acquisition, so I wanted to be thorough in analysis, planning, and execution. I had a home inspector check for problems with the house. He checked the electrical, cooling, foundation, plumbing, water heater, and roof. Issues were pointed out with the electrical, gas valves, air conditioner ductwork, and a couple of other minor things.

I brought in the following for estimates:

- An electrician to fix the issues pointed out by the inspector and to add GFCI outlets near the sinks.

- A plumber to replace supply valves & faucets in the kitchen and bathroom, gas supply valves for the stove and water heater, and to re-route the overflow drain for the water heater.

- A HVAC contractor to replace the ductwork.

- Multiple contractors to bid on the rest of the rehab stuff.

I thought I had things well covered. I was wrong. The first shock was that we had to replace the whole interior HVAC system. The furnace part was rusted through and a fire hazard. That wasn’t too bad, as we had a buffer in our budget for overages and $4,200 wasn’t going to kill it. (That price did include replacing the duct work.)

The next surprise was after the first tenants moved in, they attempted to wash clothes and the washer drain overflowed into the utility room. A phone call to the plumber and a day of trying to unclog the drain, it was determined that years ago, when the neighborhood was converted over to municipal sewerage, the original owners never bothered to tie in the utility room drain to the main drain line and just left it connected to the main field drain in the back yard, which had since collapsed, thus restricting flow and backing up into the utility room. Add another day for the plumber to route a drain through the wall and across the back patio (most likely the condemned septic tank) and tie it into the main drain line at a total cost of approximately $700.

Caveat: We will have to eventually add a full drain line underground tied into the main system.

#SilverLining: We will now have the drain necessary to convert part of the utility room to a half bath at some point, increasing the value and desirability of the property.

At one point, the original owners of the house upgraded the windows to vinyl double-paned glass. In doing so, there were gaps in between the windows and the sill in some rooms. I notice them, but in triaging everything that needed to be done, they kept falling to the bottom of the priority list. And, they never got done. Additionally, we kept finding wasps in the room where the gaps were the biggest. It seemed unrelated. The tenants actually correlated the gaps with the wasps continuously appearing in that room and asked for me to fix it. It didn’t take more than some expanding foam and caulk, but, like the other items listed here, I should have recognized the issues and fixed them prior to the tenants moving in. Total cost for the fix: about $25.

So, for the next property we purchase, I will make sure that we check all drains for restrictions, ensure all trim are sealed, and plan to continue to have the HVAC contractor evaluate the heating & cooling system. This will help to save extra work that we did not budget for and aggravation for us and the tenant in getting the issues mitigated.

If you have rental property, have you run into things like this? Let me know in the comments below.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.