Hey everyone, Clint here, bringing you this week’s episode of Wealth Building Wednesday, with some practical advice on managing debt. Here’s some quick tips on what works and what doesn’t in the realm of debt.

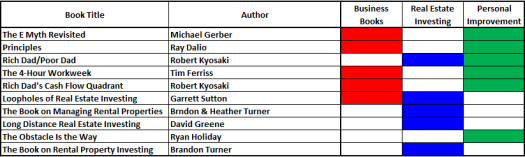

Good vs. Bad Debt: First things first, not all debt is created equal. There’s the kind that’s working for you, like investments in real estate that bring in more than they take out. Robert Kiyosaki likes to promote good debt as debt used to purchase assets. He describes assets as anything that brings you a return.

Then there’s the kind we’d rather avoid—high-interest culprits like credit card debts. It’s OK to have and use credit cards, but not to carry a balance on them. You should pay them off every month either when they are due or before they are due to ensure you don’t pay interest. This is a good strategy if you don’t have a balance or have paid off your balance. If you already have a balance on your credit card(s), see below how to eliminate them.

Mortgages can be a smart play if you’re investing in your future home, as long as you maintain the home and can expect decent appreciation. Even then, it will depend on what your interest rate is. If it is low, as in less than 5%, you may not want to pay off your mortgage, unless you would feel better not owing anything on your home.

Student loans are a mixed bag depending on what you’re aiming for career-wise, what type of loans you have, and again, what the interest rates are. Students should be informed on the expected ROI of their chosen degree program. The same degree program at different schools can range from a moderately positive ROI (165% or so) at one school to an extremely negative ROI (-450% or so) for a music education degree. This information was found here when researching in-state music education undergraduate degrees in Louisiana for my oldest daughter. The fact that Northwestern State University had the highest ROI for that degree and the largest amount of scholarships offered between, she will wind up with an almost infinite return for her degree.

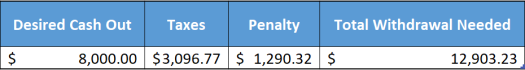

Tackling the Debt Dilemma: We’ve touched on strategies like the debt avalanche and snowball methods before—both solid tactics depending on whether you want to hit the high-interest debts first or knock out smaller debts for quick wins. The goal? Eliminate your bad debt so you’re not bleeding money on interest and can focus on growing your wealth.

Why It Matters: Let’s be real…debt can be a drag on your financial journey, especially if it’s the kind that doesn’t give back. Shaking off that debt means more freedom to invest in your future, and that’s what we’re all about here.

Eliminating your debt will give you options…and thee who hath the most options, wins!

Got a question or a thought to share? Leave a comment or shoot me an email; I’m here to help or dig deeper if needed. And hey, if you found this chat helpful, why not share it with a friend?

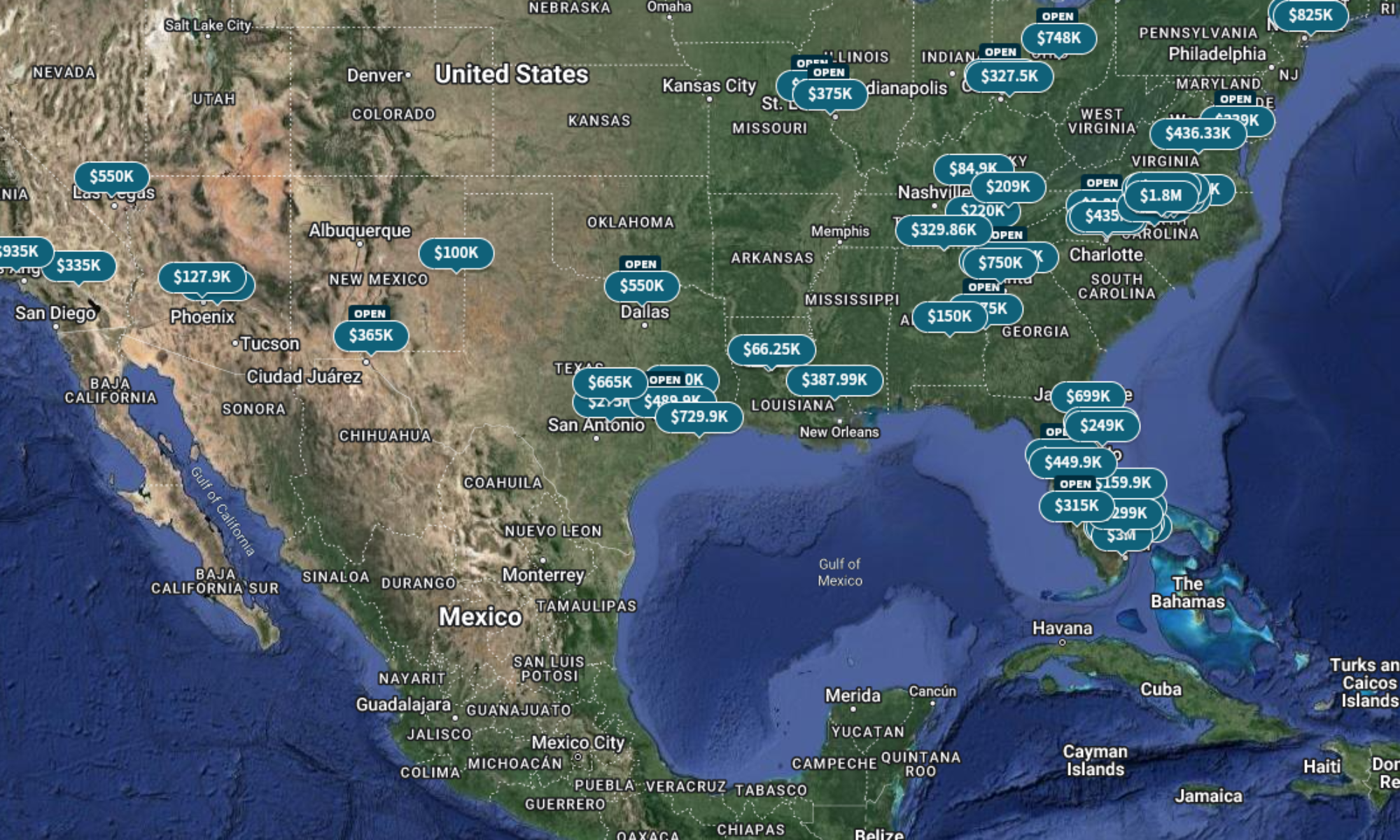

Clint C. Galliano, a native of Lafourche Parish, has lived in the Houma-Thibodaux area for over 36 years and is currently a REALTOR® with Keller Williams Realty Bayou Partners in Houma, La. He has been involved with real estate investing since 2017 and hosts the local Real Estate Investment Association. Real Estate is his passion. Clint previously worked in drilling fluids and drilling fluids automation for 28 years. He lives in Bayou Blue with his wife and two daughters.

Clint C. Galliano, REALTOR®

985.647.4479

clint.galliano@kw.com

Licensed by the Louisiana Real Estate Commission

Keller Williams Realty Bayou Partners

985.262.4400

307 Bayou Gardens Blvd

Houma, La 70364

Each Office is Independently Owned & Operated