Today’s topic is about reviewing your insurance coverages and ensuring that you are properly covered at the best rate. It also touches on customer service and some things that caused me to look for a change.

Isn’t it crazy that it is December already? The end of the year, the end of the decade. Here at the Galliano household we are busy buying Christmas gifts for the family and coordinating our schedules for band concerts, choir concerts, and a birthday.

It is also about paying year-end bills…we have property taxes on our rentals, but that is covered easily by the rent. We also have property taxes on our residence and another property. We can’t do a whole lot about what we are paying on those taxes.

Then there is insurance. Since we paid off our mortgage years ago, we have to purchase homeowners’ insurance outright. AND, since we originally moved into our house right before Christmas, our insurance comes due at Christmas time.

On top of that, our auto insurance is due on 02-Jan-2019. So that totals up to a lot of bills at the end of the year.

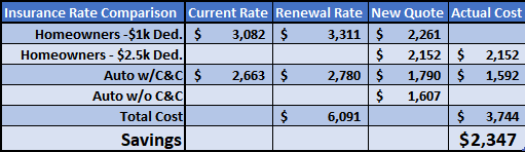

The current (as of this writing) agency we use has been providing me with insurance for around 20 years. But I am not happy with them. Over the last four to five years, my “agent of record” has changed at least four times. And the only way I find out about it is if I call with a question. On top of that, when the renewal notices came in this year, they totaled to a little over $6000! I asked for a quote at a lower home value, because the company we are covered with has an auto-escalate policy and increases the coverage value every year, thus increasing the premium. The renewal value was for $291,000. My home is probably worth about $250,000 on a good day.

I also asked for an increased deductible, increasing the deductible from $1000 to $5000. They couldn’t do that. They could only do two percent. So I asked the agent to quote me for coverage on a more accurate home value. Two to three days later, I get a quote for a home value of $232,000. Yes, it was $1000 or so cheaper than the renewal quote, but it was not for the home value that I requested. Because of this, my search for a new provider began.

One of my fraternity brothers offered to give us quotes. In going through that process, we were able to get the coverage we wanted at much lower rates. Between the home and auto coverage, it only cost us $3,744, for a savings of $2,347 between the two. That is almost $200 per month of savings! That will cover a trip to Disneyworld for Mardi Gras! LOL

Tips for Insurance

Below are some tips for getting the most for the least when dealing with insurance:

- Review your policies annually to ensure accurate coverage – Make sure you aren’t paying for a home value above the replacement cost of your home

- Try to pay your policy in a lump sum – Some providers will give you a discount for paying in full

- It pays to shop prices every once in a while

- Ensure you have a good relationship with your agent – Find an agency that provides you with a single point of contact and will notify you of any changes

- Your home value is not your home replacement value

- Depending on the age of your vehicle, you may not need comprehensive and collision insurance

- Be in a financial position to be able to pay your policies lump sum

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my articles, please share them with others and subscribe to this site.