This week, we are going to talk about spending, spending habits, and debt. As I related in a couple of previous posts, My History With Money, Pt. I & My History With Money, Pt. II, I had a bit of a spending problem. While the majority of my debt was from my mortgage, I was having trouble keeping up with payments and just keeping cash on hand. Hopefully, I will be able to provide you with some insight into why we spend and get into debt.

First, here are some statistics I gathered on income and spending in the US:

- The average pre-tax income for people living in the US in 2016 was just under $75,000.

- The average annual expenditures for people living in the US in 2016, including food, housing, transportation, discretionary spending, and insurance was slightly over $57,000.

- Add to that, the average amount of taxes paid between local, state, and federal in US as of last year is about $10,500.

- What you wind up with is about $8,000 a year (or $666.67 per month) of savable/investable income, based on averages.

The problem with averages is that it smooths out all of the variations in the data. In simpler terms, not everybody can recognize that excess money at the end of the year.

Here’s another bothersome statistic: 43% of Americans in the US spend more money than they make, according to the Federal Reserve.

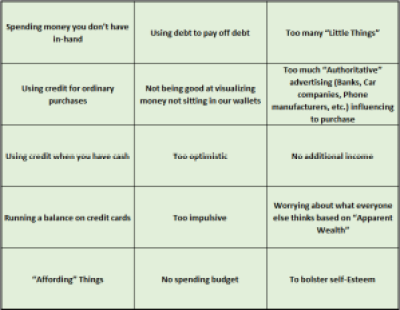

|

| The most common reasons people spend more than they make. |

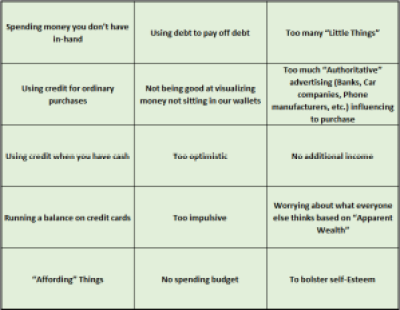

How to address the reasons listed above

If you are in the situation where you are spending more than you make and/or are in a lot of debt, the first thing to do is commit to changing your habits and then doing some things to change your situation.

Budgeting:

Be aware of what money you have coming in and what money you are spending. Break out your spending between necessities and discretionary. Necessities are electricity, water, gas, mortgage/rent, food, transportation. Discretionary spending covers items like cell phones for every member of the family, cable, internet, visits to the casino, cigarettes, beer, and similar things that are not vital to your survival.

Figure out approximately what percentage of your monthly income is needed to cover each necessity and allocate a little more than that requirement to be put aside to cover each one. I suggest putting cash into envelopes labeled for each one. By putting a little more into the envelope, that will help to cover variances in income and costs. This idea is actually based on the ideas put forth in the book Profit First by Mike Michalowicz. The book is aimed at entrepreneurs trying to get their business to a profitable state, but the principles apply to personal finance, also.

They KEY thing is to not touch the money once you put it aside unless you are paying the bill it is dedicated to.

Make sure you are also able to put aside an emergency fund. The amount should be approximately three times your monthly income/take home pay. This goes a long way towards keeping your life steady in the event of bad weather, vehicle breakdown, illness, etc.

Try to stick to only spending on necessities until you are comfortably out of debt. Then start looking for ways to invest some of your “profit” to make you more money. (Since I am not a financial advisor, I can’t offer advice on how to invest that money, but I will cover my thoughts on the matter in a future post.)

Credit cards:

Only use them if you have the money to pay for what you are purchasing and can commit yourself to not spending the cash on anything other than paying your credit card bill. If you have a balance on your credit card, don’t use it at all until the balance is paid off. Only then should you use a credit card to buy stuff.

If you already have a balance on your credit card or even multiple cards, work on paying off those balances first. There are two approaches to methodology when doing this, either start paying extra on the card with the highest interest rate and balance, if you can make yourself do that regularly without getting disappointed or pick a card with the smallest balance and pay it off first. This will give you a self-esteem boost by way of accomplishment.

DON’T PUT ANYTHING ELSE ON THAT CARD!

After the first one is paid off, take the monthly allotment of your income that was dedicated to paying off that card and start adding it to what you are paying on the next card. Keep doing that until all of your cards are paid off.

PAY OFF YOUR BALANCE EVERY MONTH!

This is crucial for not accumulating debt. It may even be better for you to have a charge card like American Express, where you are required to pay it off every month.

Don’t “float” your balance from one new card to another without paying it off. It ends badly.

Psychological Reasons for Spending

We are constantly being bombarded with advertising trying to influence us to spend money. Whether it is buy a new car, get the latest phone, or use our credit card to buy your dreams. Advertising implies that if we don’t spend, we are a lesser person. Don’t believe it!

Yes, you do need some of the things you see advertised, but you don’t need to go broke or get in debt to get it.

Buying things to feel better about yourself actually make you feel worse in the long run.

DO something to change the things in your life you don’t like. Don’t waste time worrying about the things you can’t change, because it will only make you feel worse.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.