I would like to know more about my readers. If you could spare about 2 minutes of your time, please take a survey to tell me what you like about the blog. Just click here to take the survey.

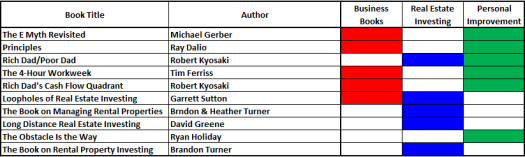

Welcome back to another installment of Things I Think About! This week I am going to go over a few books that I have read recently that have had an impact. While some of them cover a mix of topics, to me, they mostly fall into one topic. Because of this, I will break them out by topic and detail the crossover topics, and why I feel that way, for each book I also have them listed separately on my Recommended Books page, HERE.

Business

The E Myth Revisited by Michael Gerber

This book speaks to my soul! I “read” the Audible version, (as I do most books due to my 3-hour plus daily commute), recorded by Michael Gerber himself. This book details why a lot of “Entrepreneurs” find themselves overworked, underpaid, and without the ability to grow. It is an interleaved mix of example stories with lessons explaining about each story. The main focus of the book is to explain why developing processes and systems for operating your business will allow you to employ other people to work IN the business so you can work ON the business.

The 4-Hour Workweek by Tim Ferriss

A young Tim Ferriss relates how he figured out how to not be locked into common misconception of the American Dream…go to school, get a good job, work like a slave for 20-30-40 years, then retire at an age where there is a good chance that you will have trouble enjoying life. In the 4-Hour Workweek, he details the concepts of mini-retirements, becoming effective and efficient in whatever you do for work, and ideas for small businesses that require little to no maintenance to support you on an ongoing basis.

Granted, as even pointed out in the book, the goal is not to be able to lay on the beach drinking mai tais, it is to free you up to do the things you want to do, including world travel, learning languages, and/or working with non-profit organizations.

This book also qualifies as a personal Improvement book, because a lot of the recommendations for efficiency and effectiveness while working have helped me to reduce a lot of stress at my main job.

Rich Dad’s Cash Flow Quadrant by Robert Kyosaki

This book breaks out the different classifications of people earning money. ESBI stands for Employees, someone who works for someone else to make money, Self-Employed, a person working for themselves to make money, Business Owners, owning a business & employing other people, and Investors, those who employ their capital to buy assets. It promotes the idea to be either a business owner or, ultimately, an investor, as this usually provides the best returns on time & money.

Personal Improvement

The Obstacle is the Way by Ryan Holiday

Ryan Holiday is a devoted Stoic. He has multiple books and a website dedicated to Stoicism. This book is kind of a manual for achievement. I really enjoy it because it basically lays out my philosophy on life. The short version is “Do what you can to change the things you don’t like in your life…Ignore the things you can’t change.” The Obstacle is the Way takes it a step further in that it guides you to figure out how to change either the situation or your thinking about the “things you can’t change”.

Rich Dad, Poor Dad by Robert Kyosaki

Robert Kyosaki tells the story of how he grew up a poor kid, but due to the tutelage of a friend’s father, learned to become a businessman. The book is a simple read but puts forth important concepts…assets are only assets if they will make you money, don’t spend foolishly, and educate yourself to grow. There is also a good bit of advice on real estate investment as a vehicle to become wealthy.

Principles by Ray Dalio

Ray Dalio is one of the richest men in the world and got that way by building one of the top hedge fund management companies, Bridgewater Associates. In Principles, he relates his lis life and how he got to where he is, developing his principles for business and personal life as an operating system along the way. This is another Audible entry where the author reads the book to you. It works.

Real Estate Investing

Long Distance Real Estate Investing by David Greene

While I don’t invest in real estate outside of my back yard, (for now), this book is incredibly useful as a guide of how to do things. The methodologies and techniques laid out here will work even in a local market. It’s a mix of strategies, tools, and tips to be successful.

The Book on Rental Property Investing by Brandon Turner

This book is a thorough primer for anyone wanting to get into rental properties as an investment. It covers everything from finding properties to rehab tips and beyond.

The Book on Managing Rental Properties by Brandon Turner and Heather Turner

Hmmm…the title sounds a bit familiar…YES! This is the follow-up book to The Book on Rental Property Investing. It picks up where the previous book left off and takes a deeper dive into what you need to do to manage properties successfully.

Loopholes of Real Estate Investing by Garrett Sutton, Rich Dad Advisor

Another Audible author read, Loopholes covers the benefits of and hazards to watch out for when investing in real estate. I have probably listened to this book at least 6 times…right up there with the 4-Hour Workweek and The E Myth revisited. Lots of great advice.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.