Welcome back!

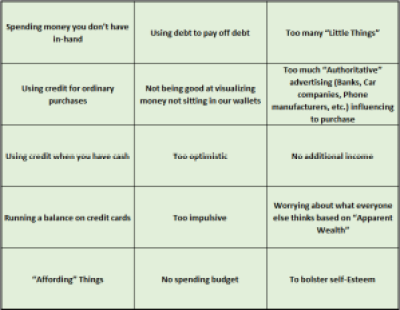

This week I am going to go over how NOT to spend your money. There are lots of good things to spend money on, but I continually observe people spending money so they can feel like they are keeping up with the Joneses or because they “deserve” it. And avoid misunderstanding, I am not advocating frugality, just better decision-making when spending money.

Everyday Observations

Bad spending habits observed recently:

Withdraw money from an old 401k account to go on vacation

Spending money to set up a business, but with no initial business activity

Early 401k Withdrawal

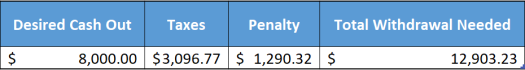

If you have money in an old 401k, use it for the intended purpose: Savings for retirement! It is understandable if you have a hardship and need the money to help deal with that, but just pulling the money out to go on vacation is a bit ridiculous. In addition to diminishing the amount of money to be available at retirement, you also have to pay a penalty on the money you withdraw, in addition to taxes at your current rate.

As an example, assuming a 24% tax bracket, if you want to use $8000 to go on vacation, you will need to pull out almost $13,000 to cover the $1,290 penalty and approximately $3,097 of taxes to end up with $8000 to go on vacation.

Not only do you lose 34% off of the top of your money, you also loose any additional earnings by not having that total amount of money still invested.

I would like to know more about my readers. If you could spare about 2 minutes of your time, please take a survey to tell me what you like about the blog. Just click here to take the survey.

Setting Up a Business Entity with no Business Activity

I understand the desire to get out of the rat race, to start your own business, and not have to work for someone else. I am right there with you! But take a practical approach. Take a practical approach. I see people starting up LLC entities, putting up websites, and paying for business infrastructure before they have any business activity. That is definitely putting the cart before the horse. If you spend that money, but do nothing in the way of generating business, then that is a wasted expense.

You would do better spending money on actual business-generating activities than paying for infrastructure before you need it.

Suggestions

Vacations

Plan your vacation as inexpensively as possible. Don’t skimp, just don’t pay $1200 a night for a room when you can rent a whole condominium or home for $110 per night in the same area.

Carry snacks and drinks with you so you don’t have to pay $4-$5 a person for snacks and $3-$4 per person for drinks. No need to carry enough for the whole day, but if you can save $28-$36 for one round of snacks & drinks a day, that cuts your total expense.

Save money until you have enough to go on vacation.

Businesses

Start your business on minimal infrastructure. Start conducting business now, then add infrastructure as you really need it.

Have a detailed realistic business plan. Plan out costs, expenses, margin, target audience, etc. Know these things before starting your business, much less spending money on infrastructure.

Hopefully these suggestions helped you out. Please comment here with any questions or suggestions regarding tips, tricks, and ideas for judicious spending.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.