This week is a bit of a follow-up to last week’s article about finding your breakeven point. I covered what you needed to look at and why it was a good idea to know what your breakeven point was before you get into a business. Now I will apply similar principles to Real Estate Investing.

Today, I am going to go over what I look at when I evaluate a property to add to my portfolio. My strategy for real estate investing is Buy and Hold, meaning that I buy properties and intend to keep them long term, renting them out to tenants.

Cost Assumptions

For cost assumptions, I use the asking price, and an estimated cost of improvements (rehabbing property) & estimated closing costs (approximately 3% of price of property).

Finance Assumptions

Use a mortgage calculator to determine monthly debt service payment. Set the desired term (15 yrs, 20 yrs, 30 yrs, etc.), down payment, and interest rate.

Gross Rents

Gross Rents are the total rents expected to be collected on a monthly basis. This can be rent form a single-family home or a multi-family property such as a duplex, triplex, or larger apartment property.

Vacancy

To account for vacancy and deduct a percentage from your gross rent before deducting expenses. I generally use a conservative vacancy percentage like 10%. While I will more than likely not have 10% vacancy in a year, accounting for it helps me to ensure the property will always cash flow.

Expenses

So, once I have a property to analyze, the first thing I do is verify the expenses. For the most part, the costs should be relatively the same, with the exception of property taxes.

I account for the following expenses:

- Property Taxes

- Insurance

- Maintenance & Repairs

- Utilities

- Advertising

- Administrative

- Variable Cost Property Management

- Lawn Care / Landscaping

- CAPEX

Property Taxes can usually be found on the local parish or county assessor’s website. You just have to search for the property address and all of the details for the property are listed. Who owns it, what municipal assessed value is, what the property has sold for, and what the city and parish/county taxes are estimated at for the current year.

Insurance can be estimated by getting a quote from your insurance agent/provider or if you have a similar property, you already have an idea what the cost is.

Maintenance & Repairs covers anything short of replacing major components of the property.

Utilities are what you expect to pay for utilities while doing turnover or when the property is unoccupied between tenants.

Advertising is the costs for paid advertising to attract tenants.

Administrative are the costs for anything administrative to do with operating the property as a rental. This covers book keeping, accounts payable, accounts receivable, etc.

Variable Cost Property Management is a percentage of gross rents paid to a property manager to manage the property. I account for this as an expense even though I manage my own properties so in the event I decide to engage a property manager, I already have that cost covered and don’t have to worry about adding a PM cutting into my cash flow.

Lawn Care/Landscaping covers grass-cutting when the property is not occupied and/or if the property is a multi-family property where the tenants don’t normally take care of the lawn.

CAPEX is an amount put aside to cover major repairs such as replacing the roof, appliances, flooring, plumbing, electrical, etc. That way, you have the money to cover these repairs instead of worrying where to get the money from.

The Analysis

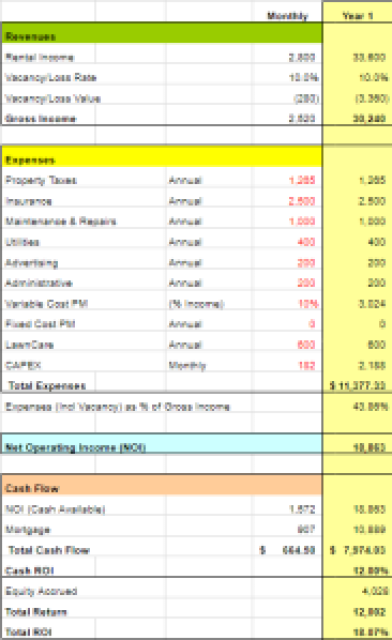

Once I have gross rents, vacancy, cost assumptions, and expense values collected, then the analysis of the property can begin. I use a spreadsheet to conduct my analysis and it is set up to tell me what I need to know. There are inputs for all of the items listed so far.

I enter the asking price, my desired finance terms, estimated gross rents, and estimated expenses.

I then evaluate whether or not my targets are met at the property’s asking price. If it does not, I then start adjusting the price downward until I reach my target numbers.

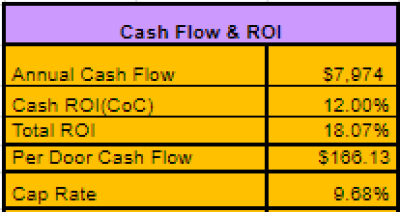

For me to consider a property a good deal, it must meet the following criteria:

Cash flow >$100 per door and have >12% Cash on Cash Return, if financed

Cash flow >$400 per door and have >6% Cash on Cash Return, if purchased cash

Be in a decent neighborhood

Cash Flow

Cash Flow is the amount of money from gross rents (revenue) remaining after expenses and debt service are covered.

Cash on Cash Return

Cash on Cash Return is the annual amount of return you get compared to the amount of cash you spent to acquire the property.

By comparing gross rents, total costs, expenses, debt service, and returns I am able to decide if a property will be a money-making addition to my portfolio. By continuing to add properties to my portfolio that cash flow, I get closer to my “Freedom Number”. Where my passive rental income covers my personal costs and expenses, so I don’t have to worry about needing a job.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.