|

| “The break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal.” |

This week’s topic is knowing your costs for your business or the Break-Even Point (BEP).

Before starting a business (or buying one), you should understand what your Break Even Point is. The BEP is where you have enough revenue coming in to cover all of your expenses. It means $0 in profit, but also that all expenses are covered.

Knowing what your BEP is can be beneficial in evaluating how much of your product or service you will have to sell to begin generating profit. It is always better to have this information before engaging in a business rather than trying to figure it out after you are already involved.

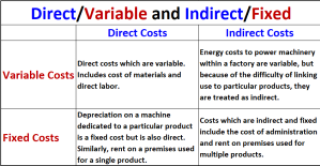

Direct Expenses

When determining the BEP, there are some differences between how to calculate this information for a Service Business and a Manufactured Products Business.

- Service Businesses are fairly easy in that you only need to tally up your direct expenses. This could be done on a monthly basis, but if you have expenses that come up at different times of the year, it is easier to estimate a total annual expense and divide it by 12 to give you a monthly expense amount. (At least that is what I have found when analyzing rental properties).

- Manufactured Products Businesses are slightly more complicated in that you need to understand what the Gross Profit (GP) on the products are. Gross Profit is the Total Sale Price minus the Cost Of Goods Sold (COGS – materials, labor to assemble). Once you know what your GP is, you will be able to calculate the BEP for the product.

The next step is to gather all of your indirect expenses. This can include rent, utilities, sales, and distribution expenses. Anything that is not directly involved in the provision of a service or the manufacturing of a product.

Once you have all of your numbers, you can calculate your BEP.

For Service Businesses, your BEP is the sum of your direct and indirect expenses. If you bring in enough revenue to cover just those expenses, you have broken even.

For Manufactured Products Businesses, you simply divide your indirect expenses by your GP % to arrive at your BEP.

Example: Indirect Costs: $20,000; GP: 31%; $20,000/0.31= $64,516.13

As I stated above, it is a good idea to have this information before you are involved in a business. Once you understand where you stand with reference to a BEP, you can start to work on optimizing you costs & methodologies to increase efficiencies, lower costs, and lower the overall BEP for that business.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

Discover more from The Clint Galliano

Subscribe to get the latest posts sent to your email.

This is great stuff. Thanks for sharing!