Today’s article is a guest post from Howie Bick.

Things To Keep In Mind When Starting A Business

Building or creating a business is an endeavor that incorporates a variety of different factors, and touches upon multiple different topics. Within the building of a business, there are lots of ideas to think about, like the amount of capital you may need in order to begin, the type of overhead or expenses you may have on a monthly basis, the type of market or demographic you’ll be catering to, and the type of competition that’s out there. The business landscape is one that requires business owners or managers to manage and handle a variety of tasks and wear multiple different hats at once. Keeping these things in mind, and having a good idea of what’s ahead, will be beneficial for anyone trying to build or create a business.

The Market or Demographic You’re Catering To

Each business or company has a particular demographic or market that they are looking to cater to. The market or demographic a company or business is looking to cater to, is often a group of people who have something in common, like a problem, an issue, or a desire they’re looking to solve. It can be something they need, desire, or want, but the business is looking to provide a solution or deliver the type of results their customers are looking for. Figuring out the market or demographic you’re looking to cater to, is a great place to start. That way, you can get an idea of the types of services they may be looking for, the type of products that may interest them, or the type of solutions they may be looking for. The way a business positions themselves, with their offerings to their customers, plays an important role in the way potential customers view them, and the way they’re viewed within the marketplace.

Competitive Advantages or Competitive Edges

Businesses that are able to carve out a particular niche, or area where they’re successful, often have a competitive edge, or a competitive advantage over the competition. A competitive edge is something that a business does better or more effectively than their competitors, or something that allows them to differentiate themselves within the marketplace. It’s an important element to any company or business, that’s looking to compete in a market where there are lots of options, and many parties looking to fulfill or satisfy their customers desires. Companies can develop competitive advantages through their prior experiences, the type of packages or services they offer to their competitors, or the type of knowledge or information they may have that others don’t. It’s something that’s important to keep in mind, when you’re evaluating whether you may be successful in a certain market, or whether you’re capable of differentiating yourself among the competition.

The Initial or Upfront Costs Associated With Starting

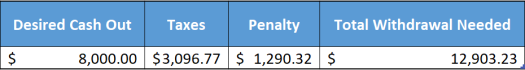

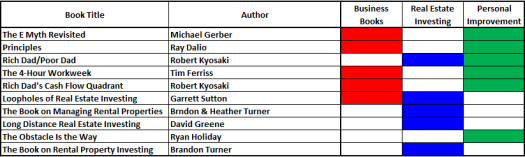

Every business requires a certain amount of investment, or capital in order to begin operating. Whether it’s getting a space and signing a lease, or acquiring the type of machinery you may need to operate, the costs associated with creating or building a business depend on the type of company you’re looking to build, and the types of products or services you plan to offer. It’s important to have a sense of the amount of capital or investment it may cost to create a business. It’s a tough situation when you decide to start a business and invest the capital or resources you do have, to later find out that you don’t have enough, or need to obtain more. By having an idea or a sense of the type of investment a certain business requires you can prepare or plan in advance or prior to creating the business and be better situated to develop or create the business you were looking to build.

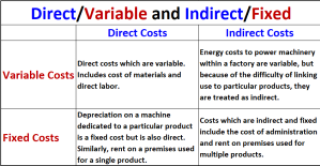

The Monthly Costs or Expenditures

Similar to the amount of capital or investment you may need in order to start or build a business, having a sense or an idea of the types of costs or expenses that your business may accrue or cost on a monthly basis is an important metric to keep an eye on. The age-old business equation is revenue minus expenses equals profit. By having an idea of the type of expenses you may accrue, you’re able to get an idea of how much business you need to do, or how much revenue you need to generate in order to make money in a month. You’re also able to have an idea of how much capital or money you need to keep on hand to continue operating and continue running the business. The monthly costs or expenditures associated with a business is an important figure to keep an eye on, and to monitor during the operations of a business, and prior to starting or creating a business.

Personal Expenses Continue to Accrue

Whenever you’re starting something new, a new job, a new company, or a new business, it’s important to keep in mind that your personal expenses continue to accrue. In the beginning stages of building a business, it often takes a bit of time to get going, and to start making the type of money you’re looking to make. That’s why, it’s important to consider that even though you may be starting a new business or a new company, which is great and congratulations, that you’ll still need to find a way to pay bills and provide for yourself. It’s something that’s a bit of a struggle for a new business owner, who’s truly looking to build a business to support themselves, or to generate the type of income they’re looking for. Preparing and planning in advance is something that can be very beneficial to lightening the load and making the transition an easier process or ordeal for you financially.

Conclusion

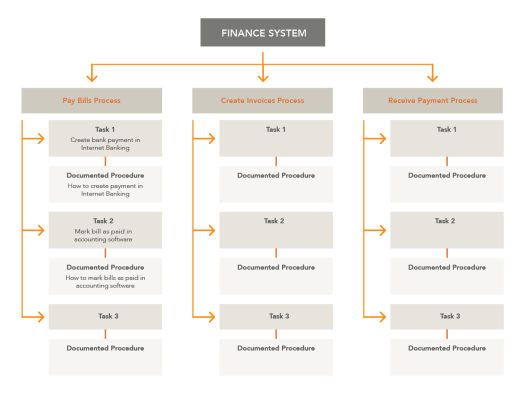

Building a business is something that comes with lots of different ideas to keep in mind and brings in to play lots of different factors as well. The market or demographic you’re trying to cater to, is an important part of any business, as it’s the group of people or companies you’re looking to interact with and find a way to provide value to. The competitive edge or competitive advantage a company has, is important in a company’s efforts to stand out within a marketplace or find a way to differentiate itself among its competitors. By having a sense of how much capital or investment you might need to start a business, you can have an idea of whether you have enough to begin, or whether you need to wait longer, or figure out another way. Having that sense of how much investment it might require, can save you spending lots of your money on something that may not be feasible just yet, or a bit out of reach. The monthly costs or expenditures that a business requires, is important to know how much revenue you need to generate, and the type of capital or money you need to keep on hand in order to continue operating. A lot of what corporate finance is, is managing the finances behind a business, making sure that the business has what it needs to continue operating, and finding ways to continue to grow and develop the business as well. Even though you may be starting something new, and you need time to bring it into fruition, personal expenses are something that continue to accrue, and are important to keep in mind when building a business. All in all, creating a business is something that comes with lots of different factors, a lot more than the few we were able to highlight. We hoped this helped and shined light on some of the important factors to consider when starting or creating a business.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my articles, please share them with others and subscribe to this blog.