This week we are back to business basics. I am going to go over Business Processes, specifically, and why they are important to people running small businesses, better known as entrepreneurs.

Growing up, I yearned to run my own business. I was exposed to lots of people running their own businesses and it was seductive…do your own thing, be your own boss, make as much money as you wanted to (I was a poor kid and idolized the idea). But as I grew older, I would observe these various entrepreneurs’ businesses fail and disappear. Some of it was from bad financial practices, (as covered in this story: My History with Money, Pt. I), some of it was from just bad business ideas, but as I have come to realize, all of them were due to not having documented processes & systems in place to operate their business.

What is a Business Process?

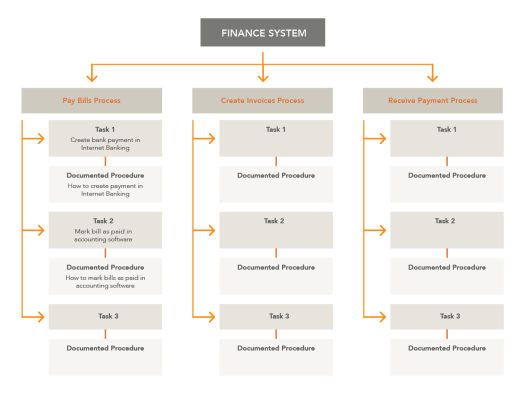

A Business Process is a map of the steps needed to be taken to achieve a goal or result. This can be the process for generating a price quotation or making a Big Mac. It is the set of step-by-step instructions to complete that task.

It can be as simple as the process detailed below:

PB&J

- Lay out 2 slices of bread

- Spread PB on one slice

- Spread Jelly of the other

- Put the 2 slices together to complete the PB&J Sandwich

Or it can be extremely detailed, for quality control and efficiency:

Peanut Butter and Jelly Royale

- Lay out 2 slices of bread that conform to the QC shape on the QC chart on the wall next to your station

- Evenly spread 1 oz. of premium natural peanut butter on the right slice of bread

- Evenly spread 1 oz of locally-sourced hand-made strawberry jelly on the left slice of bread

- Align the peanut buttered slice of bread over the jelly spread on the other slice of bread and lower it to complete the sandwich

But What About Systems?

Some mistakenly refer to the processes and systems interchangeably. In reality, processes are part of a system. A collection of similar processes make up the system. Let’s you are running a fast food restaurant and you want to ensure that the food presented to the customer is the same, every time. You would document a set of processes for each item on the menu, similar to the PB & J examples above. This collection of processes would be your Food Prep System. You would have a separate system for taking orders and another for inventory, and so on.

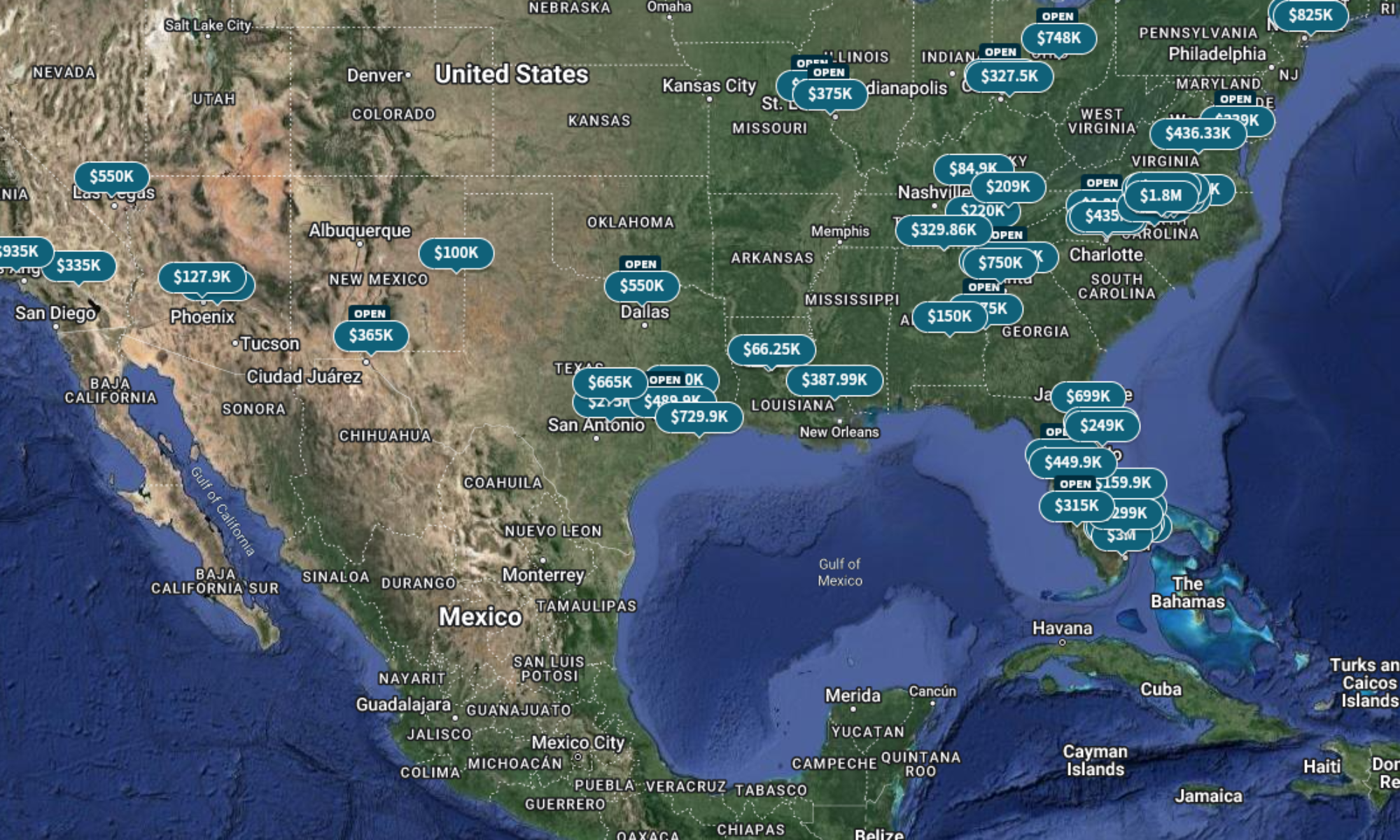

Another point about systems is that a system does not have to involve technology. There have been lots of technology systems designed to ease and automate manual systems. An easy one to bring to mind is for accounting. You have many options available for electronic accounting systems, but it is still something that could be done by hand. Not that I am advocating to accomplish your accounting by hand. In most cases, using an electronic accounting system is much more cost-effective than doing your accounting by hand. In our real estate rental business, the accounting is handled using a Google Docs spreadsheet, because the complexity of what we are doing and the time it takes to do it does not yet justify actually paying for an electronic system.

Why do I Need Business Processes?

You may ask yourself “Why do I need business processes?” Well, if you are a sole proprietor, who plans to never expand, hire personnel, step back from working in the business, or sell the business, then you probably don’t need to worry about business processes. Even though you are most likely following business processes already, if the above description fits you, you can probably get away with not documenting your business processes.

If you don’t fit the description above, these are the main reason to document your processes:

Precision and Consistency – You want to ensure that things are being done the same way every time. Borrowing from the Peanut Butter and Jelly Royale example above, if you don’t specify how much of each material to use, then you are left with each order resulting in varying quality AND cost to you as the business owner or operator. While using more peanut butter on a sandwich sometimes seems like a small thing that can be overlooked, it affects your Cost Of Goods Sold (COGS) for that sandwich, and throws off your inventory, which could result in your running out of peanut butter before your next order. This could affect your sales of the Peanut Butter and Jelly Royale until you get more product in.

Even if you are able to go out and source a spot supply of peanut butter, it will most likely further impact your cost.

**For the purposes of this example, the peanut butter sandwich and it’s ingredients are a metaphor for whatever you happen to sell in your business**

Redundancy – It is a good idea to document business processes as a kind of back-up. The reasoning behind this relies on the “Hit By A Bus” theory…If the business process is not documented, how would someone else be able to accomplish the task if the person(s) who know how to do it should get hit by a bus?

Efficiency – By having the detailed steps laid out in a business process, there is less chance of deviation of how to accomplish the task, allowing it to be completed faster. The caveat to this is that the process must already be efficient. One way to ensure efficiency is to review processes periodically to make sure they are the optimal way to achieve the task.

Scalability – Another reason you need to have documented Business Processes is to achieve scalability. Let’s say your company builds a widget and you have an opportunity to lock down a sales contract to deliver 25 widgets a month. Your business historically has only delivered a maximum of 10 widgets a month. How do you scale up your business to be able to produce 150% more product? By bringing in more employees. How do you train the new employees to be able to accomplish those tasks? By having detailed Business Processes for you Widget Production System so that employees can get up to speed faster on how to do their job and allow you to produce that increase in widgets almost immediately.

I hope I have been able to make a compelling case for why you need to have documented Business Processes and helped you to understand how it can help your business.

Here is some recommended reading on Business Processes:

4 Simple Steps to Developing Business Systems

https://www.growthink.com/content/4-simple-steps-developing-business-systems

The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It

https://smile.amazon.com/dp/B000RO9VJK/ref=cm_sw_r_tw_dp_U_x_15roBbX10PDC6

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.