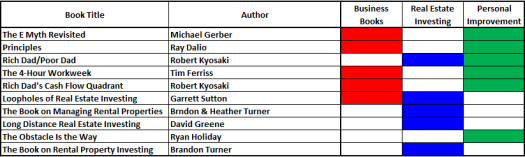

This week we are talking about different types of investments that you can utilize to better your personal finances. I’ll briefly touch on traditional investments (stocks, bonds, etc.), investing directly into a business, and various forms of real estate investing.

Additionally, I would like to give a shout-out to @DeliberateKevin for the guest post last week. Go check out Deliberate Consulting.

“Traditional” Investments

Traditional investments are what most people usually think of when they think of “Investing”. This can be stocks, bonds, Exchange Traded Funds (ETF), etc.

There are three main approaches you can use:

- Investment Advisor

- Robo Advisor

- DIY

Investment advisors usually handle clients’ money for a fee. In most cases, that fee is a percentage of the total portfolio balance. Additionally, unless the advisor has a fiduciary duty to you, the investor, they may push you towards investments where they get better or additional commissions, as opposed to investments with less fees and/or commissions involved. Also, you need a sizable balance to start your account, say, in excess of $500,000.

Robo Advisors are basically algorithms that select the best investments based for you based on many criteria. They usually invest in ETFs and can automatically do things like rebalance portfolios, automate tax loss harvesting, etc. They tend to operate on a fractional percentage commission, meaning that they are usually cheaper than a full-blown human investment advisor. Robo Advisors will also allow you to start an account with a much lower balance than a traditional financial advisor, with some allowing you to open an account with no money, though you will need to put money in to invest.

DIY or Do It Yourself is another approach you can take. It costs you no fees other than trade fees and you don’t need a large balance to start. But, you will have to spend a lot of time researching your investments and deciding where to put your money. You can start with as little as the price of a single share of stock and the trade fee.

I would like to know more about my readers. If you could spare about 2 minutes of your time, please take a survey to tell me what you like about the blog. Just click here to take the survey.

Direct Business Investment

You can invest into a business outside of stock. This can be in the form of buying a franchise, buying a share of an existing business, or even taking your non-retirement account money and opening a business. A word of caution: Be sure to perform thorough due diligence into any business you invest in like this and if investing with partner(s), ensure you have a sound operating agreement in place and that everyone abides by it.

See more on starting a business with partners: BUSINESS STARTUP: 9 TIPS FOR STARTING A SMALL BUSINESS WITH PARTNERS

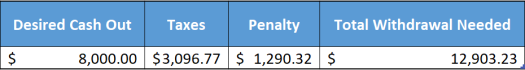

If you only have retirement account funds available, either from a 401k from an previous job or an IRA (Individual Retirement Account), you have the option to buy or start a business using those funds through a Rollover Business Startup (ROBS) transaction, also known as Business Owner Retirement Savings Account (BORSA). This allows you to utilize the money you have saved to start a business without incurring taxes or penalty. There are specific restrictions that go along with it and it has to be administered by a qualified group. Companies like DRDA and MySolo401k can help you deal with this type of thing.

Real Estate

The last type of investing option I am going to talk about is real estate. As I have talked about before, I like investing in real estate, in addition to other types of investing. Real Estate has options that range from very hands-on and intensive involvement to very passive hands-off approaches.

Direct Investment – Real Estate

If you have money sitting around, or you decide you want to follow the Tim Ferriss approach and dreamline a muse to support real estate investing, you have lots of options.

You can wholesale, which is finding people with a need or desire to sell a property that doesn’t qualify for traditional financing or need the funds in a short time period (need a quick closing).

You can Fix and Flip. This involves buying a distressed property at 30% or more below market value (where market value is considered the after-repair value or ARV) and rehabilitating the property, then selling it at or near market value.

You can also buy and hold, the term for investors that buy property with the intention of renting it out over the long term. Generally, these investors like to acquire their properties in a similar state to the Fix and Flip investors, but do not sell the properties.

A less well-known approach is to invest in Notes. These are mortgages that the banks sell off at a discount to get their capital back & re-deploy it in another loan. There are note funds in addition to you being able to buy notes directly.

Most note funds require that you be a sophisticated investor. No, that does not mean that you have to drink your tea with your pinky out and wear a three-piece suit every day. It is a category defined by the government as having an income of $200,000/year if single, $300,000 if married, OR $1,000,000 in net worth, not including your primary residence.

Self-Directed IRA – Real Estate

Like the ROBS/BORSA methodologies mentioned above for direct business investments, there is a self-directed IRA (SDIRA) that can be used to invest in real estate. They can be used to buy investment properties or, in some cases, to actually BE a “bank” of sorts.

Some caveats with using an SDIRA to buy investment property: You cannot take advantage of depreciation on the property, so you lose out on some tax benefits; You cannot receive any immediate benefit from the investment. All returns from the investment belong to the SDIRA.

Another option is to become a private lender. Basically, you are becoming the bank, lending money on a short-term basis, to a real estate investor. They benefit from quicker and usually cheaper closings and you as the lender benefit from the interest earned by lending the money, which usually is more than you will make in the bank or other investments.

Hopefully giving you this overview of different types of investing will help further your knowledge and be a starting point for your own investigation into how best to invest your money.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.