As I’ve stated in another article, I was given an early retirement package recently. And if you have read other articles I have posted, you also know that I have been preparing for retirement for a few years now. I am currently 52 years old and planned to be retired from the oil and gas industry by the age of 55.

But I wasn’t sure that we truly had enough saved and/or invested to cover things. So I kept on working.

Now, don’t get me wrong, I enjoyed most of the aspects of my job, but I was starting to get aggravated with the things I could not change or impact. And in one of my last positions, the amount of administrative busy work that was not HABU, Highest And Best Use, of my skillset.

With all of that said, being told that I was being retired early was a wonderful blessing!

Working from home for the last couple of months of employment and the subsequent five weeks or so has been a revelation. I see and hear people complaining about weight gain and complications from their chronic medical conditions during the pandemic lockdown. I did not experience any of that. In fact, my glucose levels are now sitting at a normal level, with fasting readings mostly below 100. They used to stay between 130 – 180. I have lost approximately 15 pounds.

I was also dealing with migraines due to some nerve issues in my neck. They were exacerbated by the constant stress of work.

Now, those are pretty much gone!

What I have realized over the last few days is that the stress from work was driving a lot of the issues I was experiencing. When I was still working, I would get to the end of each day and be too exhausted to do much of anything else. I would feel mal de ventre, (sick feeling in my stomach), due to worrying about the latest “crisis” occurring. It was so bad that for the last ten years or so, I rarely even had a casual drink because that would just add to the general malaise feeling, in addition to upsetting my glucose levels.

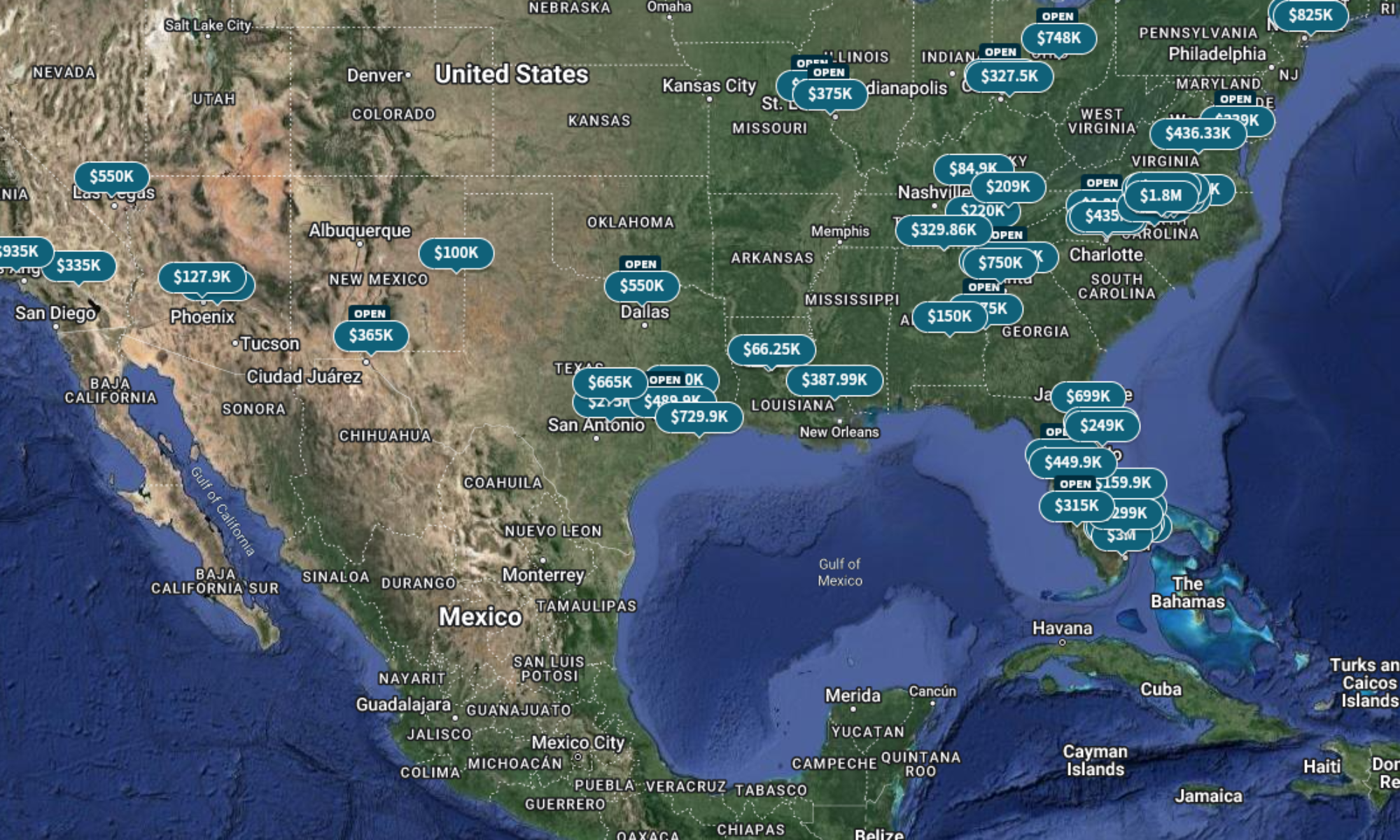

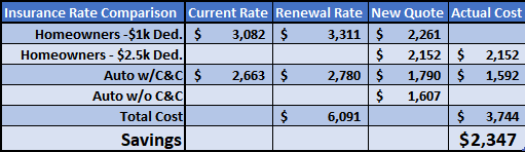

Now, I have none of those worries. I am content. I am spending more time with my family. I am preparing to take the real estate salesperson license exam to become a licensed realtor. I am continuing with real estate investing, looking for quality cash-flowing properties.

It begs the question, why didn’t I retire sooner?

Ultimately, the real answer is that I was not prepared to. After my job was changed and relocated in December, I started to figure out the HOW? of leaving the company. I have some answers, but not all. And that is OK. We have more than enough buffer to get the rest.

Cheers! from semi-retirement!

And, as always, let me know what you think in the comments. Ask questions, tell your story. If you like my posts, please share them with others and subscribe to this blog.