I want to start out this article by asking, how are you? No, REALLY…How are you holding up with all of this unprecedented turmoil? If any of you readers need to talk, have questions, or need advice, please reach out to me here. (Link will take you to a contact form. Your information will not be shared or used to sell you anything.)

While I am classifying this under Personal Finance, it also has a lot to do with Personal Improvement. We are in the fabled “Interesting Times”. In the midst of a viral pandemic, with an oil price war going on, in addition to the main response in the USA to the pandemic has been to shut down most small businesses. This is not good for individuals nor the economy as a whole. And yes, there have been attempts by the government to provide support, with individual stimulus checks and various SBA (Small Business Association) loans with potential options for loan forgiveness, the implementation was far from ideal. There were large corporations receiving small business loans in the millions of dollars. Some people believe this is the fault of the government. In a way it is, but ultimately, it was left up to the banks who administer these SBA loans to underwrite and approve them. With some understanding of the underwriting process, it seems only natural that the businesses with the best chance of paying back the loans would get approved first and for the largest loan amounts.

OK, now that I have that off of my chest, on to the main topic.

What is your level of Concern?

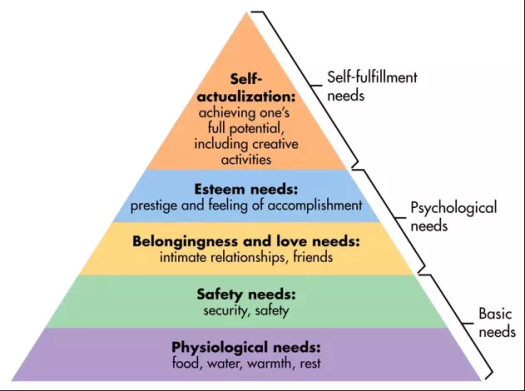

Where are you with regards to your level of concern? I feel there is a hierarchy, more or less paraphrasing Maslow’s Hierarchy of Needs. I’ll call it Galliano’s Hierarchy of Concern. Depending on your situation, you should be able to relate to the level of concern.

Each step in the pyramid parallels Maslow’s, so technically, it is Maslow’s, just through a different lens.

Survival

At this level of concern, you are just worried if you will live through the virus, if your immediate family will be able to eat, and you will continue to have a place to live.

Employment

This level is fairly obvious, but with a little more. Do you have a job? If you do, is it paying you enough to cover your needs? And if you have a job, is it one that makes you worry about level 1 concerns, like your health and wellbeing?

Savings

The next step up is Savings. Are you able to save enough on a regular basis? Are your current savings enough to carry you through should you become unemployed?

Retirement

This step assumes that you have the previous three steps in hand and under control. It is where you become concerned about retirement. Typically, this step is reached later in life, but not exclusively so. The main questions are “Am I accumulating enough to support me through retirement?” and “How soon can I retire?”.

Reallocation

Similar to the previous step, this step assumes you have the underlying foundation of the other steps under control. Reallocation should be a regular practice for your portfolio to ensure it is optimized for your goals, but in times like these, your concern can also be directed at weathering the volatility and what is the best investment for the current economy.

My advice with all of this, no matter what level of concern you are at, is to take action to improve your current situation. There are no quick fixes, only perseverance of spirit. If you are looking for motivation or direction, checkout my book recommendations. There are more than a few ideas on how to improve your situation.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

Discover more from The Clint Galliano

Subscribe to get the latest posts sent to your email.