|

| Yes, you can legally sign digital documents from your phone! |

If you like my posts, please share them with others and subscribe to this blog.

Things I Think About

|

| Yes, you can legally sign digital documents from your phone! |

If you like my posts, please share them with others and subscribe to this blog.

|

| An infographic representation of Cash Flow. |

Accrual basis – Revenue is recorded when earned and expenses are recorded when consumed.”

|

| Saving Money…Maybe you should think of it as Rescuing Your Money! |

Today we are going to talk about a very specific subject: Starting a small business with a partner or partners.

The generally understood definition by the United States government for a small business is a business that employs less than 500 people. There are financial considerations that also go along with that, but I am not going to attempt to touch on those here.

With this in mind, the concept of the US economy being powered by small business makes a lot more sense. A large majority of businesses are small businesses.

I would venture to say that there is a sizable portion of the population that if not already running a business, want to start one. Based on that, I am going to provide some tips to get started and hopefully avoid pitfalls that I have run across in my business dealings.

Select your partners well. This seems obvious, but you need to ensure that goals are aligned, that you want the same things for the business. Make sure that you can work with your partners. Make sure that your personalities do not clash. Make sure that all partners are able to understand viewpoints that are different from their own ideas and give them thoughtful consideration. Put a plan together for how you will proceed and have everyone sign off on it. Avoid partnerships where one or more partners are self-serving and attempt to obstruct ideas that do not favor them.

Define the duties of each partner for the business before investing any money, time, or effort. Agree on who does what and how it will be done. Have each partner provide a plan for how they will accomplish their duties. This seems a bit like overkill, but the effort put into this exercise will pay dividends in the form of getting each partner to think about what they will be doing and how they will be doing it. That alone is worth the exercise.

There are other types of legal entities, but this seems to be the most common structure used for small businesses. Depending on the type of business, you may be forced into using a C-Corp entity structure, such as a manufacturing business with inventory. While I am not an attorney and I do not play one on the internet, I am of the opinion that most small businesses are best served by an LLC structure.

In an LLC structure, the entity is considered a pass-through entity, so the profits of the company are passed through to the partners based on shares of equity in the company, to be reported on their personal income taxes.

With a C-Corp, the company is taxed, then dividends passed on to the shareholders (partners) is taxed again.

This is also a big one. The operating agreement can be based on the details pulled together in the Duties step. It just formalizes how the company will operate and documents the what & how for each partner. It also should contain exit strategies for each partner and for the company as a whole. This is probably more geared towards an LLC entity, but also has relevance to shareholders in a small private C-Corp.

If you already have a good idea for an entity name, then obviously, use it. But if you don’t, there is no need to stress out over it. Pick a name and as long as it is not already in use or trademarked, it will be good. If you later want have specific company branding/marketing, you can create a “Doing Business As” or DBA name. In most cases, all you have to do is file a form with the state for it to be recognized.

The Internal Revenue Service (IRS) uses the employer identification number or Tax ID as an identifier for businesses so they can track income and revenue. It costs nothing and can easily be applied for online.

Depending on the nature of your business, you may need to get a parish, county, or city business license. They are usually just a nominal fee, but not a whole lot. (Caveat: larger cities may have more exorbitant fees).

Always use a business bank account for your business finances. Keep your personal finances separate from your business finances. This will help to keep track of how well your business is doing.

For accounting purposes, you can start out tracking everything in a spreadsheet. Document revenue, document expenses. Depending on the nature of the business, you may need to do a little more than that and use an accounting software program or service. Once you reach a level where revenue and cash flow allow it, accounting tasks can be delegated to a book keeper.

I would also like to recommend using a CPA for filing your taxes. Having a good CPA on board will keep you out of trouble. Especially if a partner decides it is someone else’s job to get all documentation to said CPA at tax time. The CPA will file an extension on your behalf to keep you out of trouble.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

|

| Our Second Rental Property! |

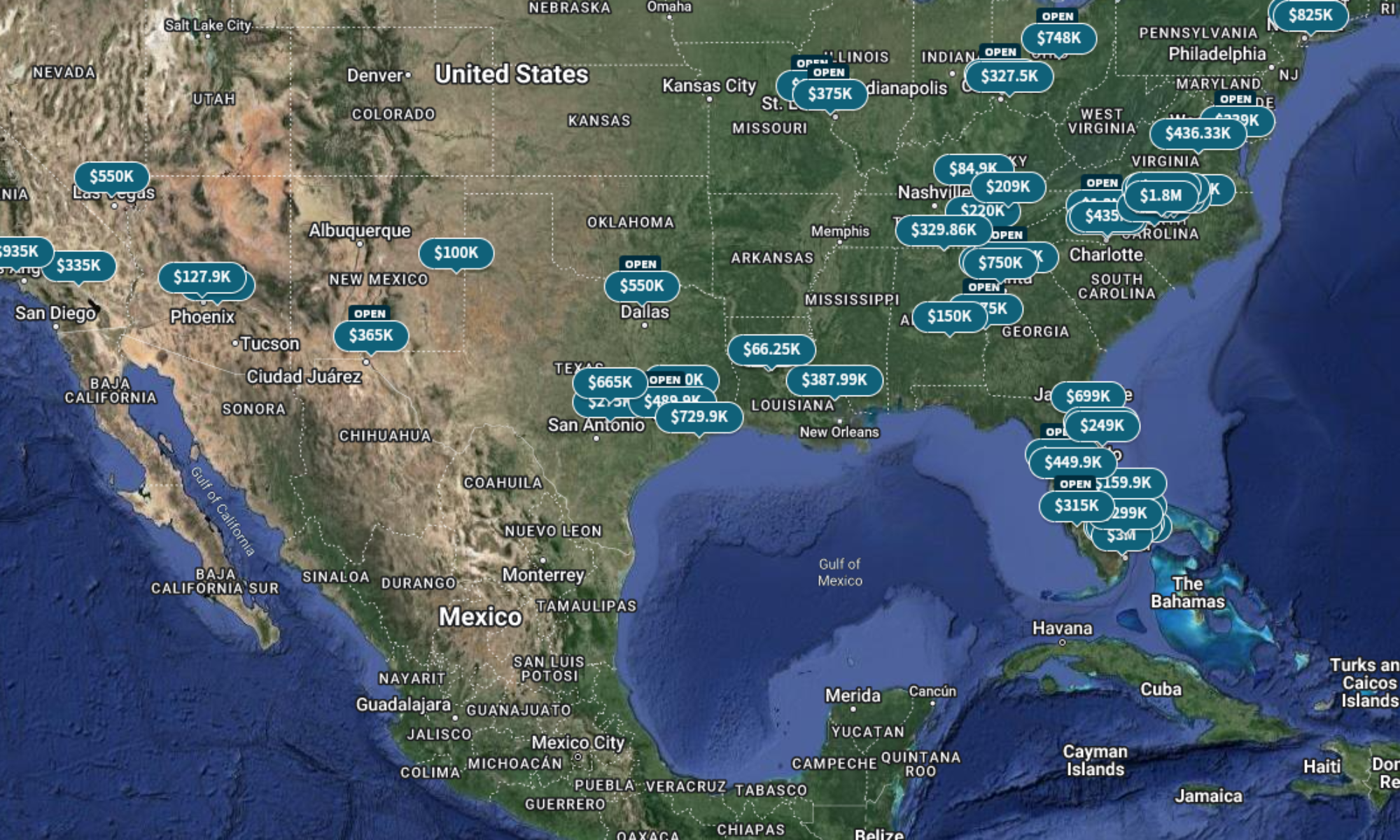

This week we are going to talk about how we found our second real estate investment property. If you have been playing along, you know that our first property was my wife’s inherited childhood home that we turned into a rental.

Because I work a full-time (+) job in addition to being a minority shareholder & director of a manufacturing business, I don’t have a marketing pipeline set up to find properties. That doesn’t mean I won’t ever have one, just that right now I am moving slowly. Mainly, my wife and I watch the MLS (via Zillow, Trulia, Realtor.com, and local real estate companies) for properties that fit our criteria. That criteria is three bedroom, two bathroom houses built on a slab foundation with central heating and cooling in decent neighborhoods. We have more or less decided to focus on the Thibodaux, La area, mainly because I am very familiar with Thibodaux and Nicholls State University is located there.

We noticed a price drop for a property just outside of the city limits of Thibodaux. It is about a 5-minute drive from the university. Initially, the property was listed at $120,000. I thought that was a little high for us to buy as an investment, so I did not pay much attention to it. The price drop was $40,000, so that was enough incentive for us to go check out the property.

In looking at the pictures on Zillow, I recognized the name of the listing agent from the sign in the yard. It was the same agent that acted as property manager when I was renting a house a block or so away from the subject property some twenty plus years ago. So, I emailed her to ask about a showing. We were able to go look at it and liked the structure. While there were some superficial repairs and painting needed, structurally, it was in good shape. We estimated that we could rehab it for approximately $20,000, with a $5,000 contingency budget in case we needed to do anything else.

Below are before pictures. More of the story after that.

We put in an offer of $72,581. It was accepted and had 10 days from their acceptance to perform due diligence on the property. We immediately lined up an inspection by our HVAC contractor and a certified home inspector, in addition to requesting an estimate from an electrical contractor.

The home inspector identified some issues with the electrical panel & feed lines and confirmed that the water damage to the ceiling tile was due to the air conditioning duct work sweating and leaking through.

The HVAC contractor identified that the furnace chamber had rusted out and the whole inside unit needed to be replaced. We had the option to replace the inside portion for $4,200 or the whole system for $5,700. If he would have to come back to replace the outside portion, it would be $2,000. We decided to wait on replacing the outside unit in the hopes that we could get another 2-3 years out of it. #ThereWentTheContingency

The electrical estimate came back at just under $2,000 to install GFCI outlets by the kitchen and bathroom sinks and to repair the panel/feed line issues, with $1,500 of it accounting for the panel/feed line issues.

I mentioned this fact to the real estate agent, who then got back with the seller and they responded with a counter offer of $71,000 for the home, basically negating the cost of repairing the panel/feed lines.

Next, I lined up a title company to close the transaction. Because the property was owned by 9 surviving heirs, it took a while for claims against the title to be researched. In addition to that, closing was delayed because one of the heirs owed child support and we had to get the district attorney to sign off on allowing the sale, as long as that heir’s proceeds were directed to monies owed.

We finally closed and began to work on the rehab. While waiting for closing, we identified a general contractor to change out doors, hang & finish drywall, and lay down new flooring and trim, among other things.

We handled painting, lighting fixtures, trim in the kitchen, and plumbing. The contractor handled everything else. It took us about 3 and a half months to finish everything and another 2 months to find the right tenants.

There were a couple of things that needed to be fixed after the tenants moved in, but it has now been six months since the lease started and everything is running smooth. The tenants are under a two year lease, so we have locked in cash flow through Q3 2019 for the property.

Because we purchased all cash, we have no debt service expenses. We may look at refinancing the property in the future, but I like the idea of cash flow because my goal is to get to the point where I can live just off of cash flow.

Numbers Breakdown

Purchase Price – $71,000

Rehab Costs – $20,637

ARV (After Repair Value) – $130,000

Annual Gross Rents – $11,100

CoC (Cash on Cash Return) – 5.38%

ROI – (Return on Investment) – 5.38%

Expenses – $4949

NOI – $5041

Debt Service – $0

Cash Flow-Annual – $5,041.22

Cash Flow-Monthly – $420.10

Cash Flow/Door-Monthly – $420.10

After pictures below:

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

|

| “The break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal.” |

This week’s topic is knowing your costs for your business or the Break-Even Point (BEP).

Before starting a business (or buying one), you should understand what your Break Even Point is. The BEP is where you have enough revenue coming in to cover all of your expenses. It means $0 in profit, but also that all expenses are covered.

Knowing what your BEP is can be beneficial in evaluating how much of your product or service you will have to sell to begin generating profit. It is always better to have this information before engaging in a business rather than trying to figure it out after you are already involved.

Direct Expenses

When determining the BEP, there are some differences between how to calculate this information for a Service Business and a Manufactured Products Business.

The next step is to gather all of your indirect expenses. This can include rent, utilities, sales, and distribution expenses. Anything that is not directly involved in the provision of a service or the manufacturing of a product.

Once you have all of your numbers, you can calculate your BEP.

For Service Businesses, your BEP is the sum of your direct and indirect expenses. If you bring in enough revenue to cover just those expenses, you have broken even.

For Manufactured Products Businesses, you simply divide your indirect expenses by your GP % to arrive at your BEP.

Example: Indirect Costs: $20,000; GP: 31%; $20,000/0.31= $64,516.13

As I stated above, it is a good idea to have this information before you are involved in a business. Once you understand where you stand with reference to a BEP, you can start to work on optimizing you costs & methodologies to increase efficiencies, lower costs, and lower the overall BEP for that business.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

|

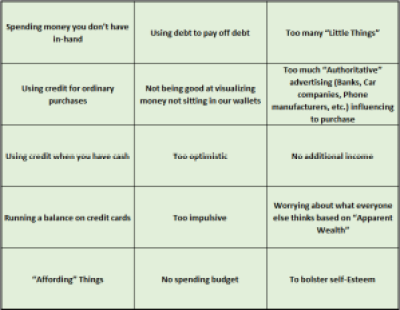

This week, we are going to talk about spending, spending habits, and debt. As I related in a couple of previous posts, My History With Money, Pt. I & My History With Money, Pt. II, I had a bit of a spending problem. While the majority of my debt was from my mortgage, I was having trouble keeping up with payments and just keeping cash on hand. Hopefully, I will be able to provide you with some insight into why we spend and get into debt.

First, here are some statistics I gathered on income and spending in the US:

The problem with averages is that it smooths out all of the variations in the data. In simpler terms, not everybody can recognize that excess money at the end of the year.

Here’s another bothersome statistic: 43% of Americans in the US spend more money than they make, according to the Federal Reserve.

|

| The most common reasons people spend more than they make. |

How to address the reasons listed above

If you are in the situation where you are spending more than you make and/or are in a lot of debt, the first thing to do is commit to changing your habits and then doing some things to change your situation.

Budgeting:

Be aware of what money you have coming in and what money you are spending. Break out your spending between necessities and discretionary. Necessities are electricity, water, gas, mortgage/rent, food, transportation. Discretionary spending covers items like cell phones for every member of the family, cable, internet, visits to the casino, cigarettes, beer, and similar things that are not vital to your survival.

Figure out approximately what percentage of your monthly income is needed to cover each necessity and allocate a little more than that requirement to be put aside to cover each one. I suggest putting cash into envelopes labeled for each one. By putting a little more into the envelope, that will help to cover variances in income and costs. This idea is actually based on the ideas put forth in the book Profit First by Mike Michalowicz. The book is aimed at entrepreneurs trying to get their business to a profitable state, but the principles apply to personal finance, also.

They KEY thing is to not touch the money once you put it aside unless you are paying the bill it is dedicated to.

Make sure you are also able to put aside an emergency fund. The amount should be approximately three times your monthly income/take home pay. This goes a long way towards keeping your life steady in the event of bad weather, vehicle breakdown, illness, etc.

Try to stick to only spending on necessities until you are comfortably out of debt. Then start looking for ways to invest some of your “profit” to make you more money. (Since I am not a financial advisor, I can’t offer advice on how to invest that money, but I will cover my thoughts on the matter in a future post.)

Credit cards:

Only use them if you have the money to pay for what you are purchasing and can commit yourself to not spending the cash on anything other than paying your credit card bill. If you have a balance on your credit card, don’t use it at all until the balance is paid off. Only then should you use a credit card to buy stuff.

If you already have a balance on your credit card or even multiple cards, work on paying off those balances first. There are two approaches to methodology when doing this, either start paying extra on the card with the highest interest rate and balance, if you can make yourself do that regularly without getting disappointed or pick a card with the smallest balance and pay it off first. This will give you a self-esteem boost by way of accomplishment.

DON’T PUT ANYTHING ELSE ON THAT CARD!

After the first one is paid off, take the monthly allotment of your income that was dedicated to paying off that card and start adding it to what you are paying on the next card. Keep doing that until all of your cards are paid off.

PAY OFF YOUR BALANCE EVERY MONTH!

This is crucial for not accumulating debt. It may even be better for you to have a charge card like American Express, where you are required to pay it off every month.

Don’t “float” your balance from one new card to another without paying it off. It ends badly.

Psychological Reasons for Spending

We are constantly being bombarded with advertising trying to influence us to spend money. Whether it is buy a new car, get the latest phone, or use our credit card to buy your dreams. Advertising implies that if we don’t spend, we are a lesser person. Don’t believe it!

Yes, you do need some of the things you see advertised, but you don’t need to go broke or get in debt to get it.

Buying things to feel better about yourself actually make you feel worse in the long run.

DO something to change the things in your life you don’t like. Don’t waste time worrying about the things you can’t change, because it will only make you feel worse.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

|

| Image from US Patent #6,293,874…”User-operated amusement apparatus for kicking the user’s buttocks” |

Today I am going to cover some things that we experienced last year while rehabbing a house acquired to become a rental.

This was our first acquisition, so I wanted to be thorough in analysis, planning, and execution. I had a home inspector check for problems with the house. He checked the electrical, cooling, foundation, plumbing, water heater, and roof. Issues were pointed out with the electrical, gas valves, air conditioner ductwork, and a couple of other minor things.

I brought in the following for estimates:

I thought I had things well covered. I was wrong. The first shock was that we had to replace the whole interior HVAC system. The furnace part was rusted through and a fire hazard. That wasn’t too bad, as we had a buffer in our budget for overages and $4,200 wasn’t going to kill it. (That price did include replacing the duct work.)

The next surprise was after the first tenants moved in, they attempted to wash clothes and the washer drain overflowed into the utility room. A phone call to the plumber and a day of trying to unclog the drain, it was determined that years ago, when the neighborhood was converted over to municipal sewerage, the original owners never bothered to tie in the utility room drain to the main drain line and just left it connected to the main field drain in the back yard, which had since collapsed, thus restricting flow and backing up into the utility room. Add another day for the plumber to route a drain through the wall and across the back patio (most likely the condemned septic tank) and tie it into the main drain line at a total cost of approximately $700.

Caveat: We will have to eventually add a full drain line underground tied into the main system.

#SilverLining: We will now have the drain necessary to convert part of the utility room to a half bath at some point, increasing the value and desirability of the property.

At one point, the original owners of the house upgraded the windows to vinyl double-paned glass. In doing so, there were gaps in between the windows and the sill in some rooms. I notice them, but in triaging everything that needed to be done, they kept falling to the bottom of the priority list. And, they never got done. Additionally, we kept finding wasps in the room where the gaps were the biggest. It seemed unrelated. The tenants actually correlated the gaps with the wasps continuously appearing in that room and asked for me to fix it. It didn’t take more than some expanding foam and caulk, but, like the other items listed here, I should have recognized the issues and fixed them prior to the tenants moving in. Total cost for the fix: about $25.

So, for the next property we purchase, I will make sure that we check all drains for restrictions, ensure all trim are sealed, and plan to continue to have the HVAC contractor evaluate the heating & cooling system. This will help to save extra work that we did not budget for and aggravation for us and the tenant in getting the issues mitigated.

If you have rental property, have you run into things like this? Let me know in the comments below.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

|

| Actual picture from one of our properties. |

One of the last things you want to do is to get scammed as a real estate investor. It will happen if you are not prepared and do not have systems and processes in place to keep you from getting scammed.

When we decided to turn my in-laws house into a rental, we started to look for contractors to do the rehab on it because I was too busy with work to do it myself (and I wasn’t that great at what was needed anyway).

We asked around on Facebook, but didn’t get a whole lot of suggestions. A friend of a relative could do some of it, but we wanted to get someone to do all of the work.

My wife heard an advertisement on a local radio station for a home improvement contractor, so we called him to get a bid. He gave us a fairly cheap bid and said he could start working immediately. We decided to use him. (Mistaken Thinking #1: Since he was advertising on the radio, he must have been a legitimate contractor.) He told us he was licensed and insured, so we believed him (See mistaken Thinking #1). He then asked for a 30% down payment to be able to purchase materials, so we paid him the down payment. (Mistaken Thinking #2: It’s OK to pay a down payment before work starts.) After six weeks of no work being done except removing the one piece of baseboard and shoe molding in the picture above, in addition to him coming to us for additional material draws (that we paid), we finally realized that he wasn’t going to do the work.

We suspected something was up after four weeks, but didn’t want to believe it. Thankfully our state has a contractor Fraud law and between our complaints and complaints of other victims from surrounding area, there was enough to arrest him. He made a plea deal and has paid back almost half of the money he owes us.

We eventually found a really good contractor who came in and rehabbed everything in the house for us in about a month for a really good price. And we have been renting out the property ever since.

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.