Overspending, Why And What to Do about It

|

This week, we are going to talk about spending, spending habits, and debt. As I related in a couple of previous posts, My History With Money, Pt. I & My History With Money, Pt. II, I had a bit of a spending problem. While the majority of my debt was from my mortgage, I was having trouble keeping up with payments and just keeping cash on hand. Hopefully, I will be able to provide you with some insight into why we spend and get into debt.

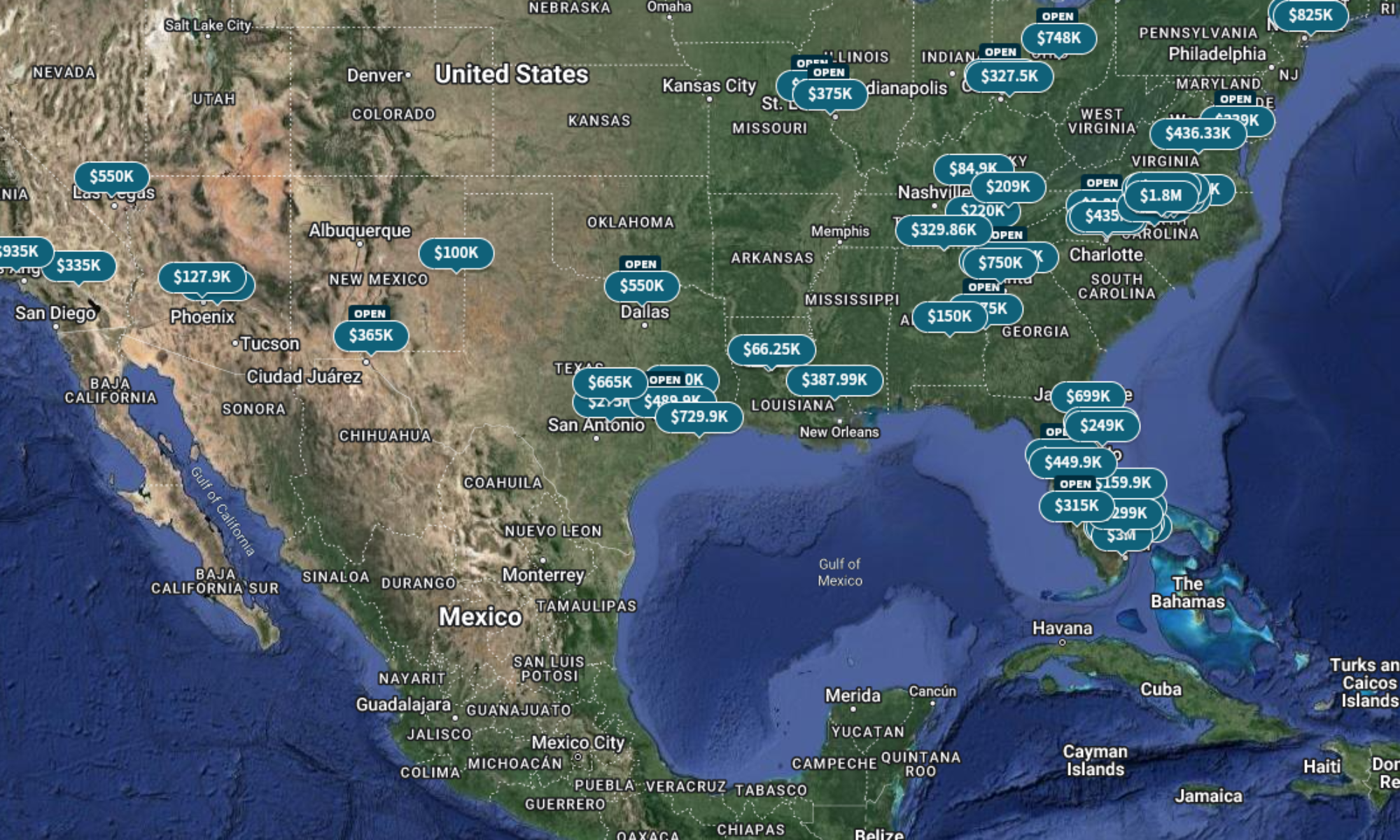

First, here are some statistics I gathered on income and spending in the US:

- The average pre-tax income for people living in the US in 2016 was just under $75,000.

- The average annual expenditures for people living in the US in 2016, including food, housing, transportation, discretionary spending, and insurance was slightly over $57,000.

- Add to that, the average amount of taxes paid between local, state, and federal in US as of last year is about $10,500.

- What you wind up with is about $8,000 a year (or $666.67 per month) of savable/investable income, based on averages.

The problem with averages is that it smooths out all of the variations in the data. In simpler terms, not everybody can recognize that excess money at the end of the year.

Here’s another bothersome statistic: 43% of Americans in the US spend more money than they make, according to the Federal Reserve.

|

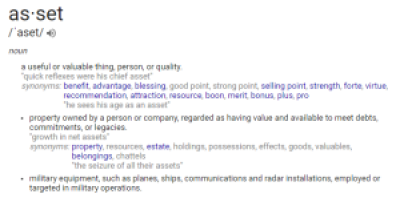

| The most common reasons people spend more than they make. |

How to address the reasons listed above

If you are in the situation where you are spending more than you make and/or are in a lot of debt, the first thing to do is commit to changing your habits and then doing some things to change your situation.

Budgeting:

Be aware of what money you have coming in and what money you are spending. Break out your spending between necessities and discretionary. Necessities are electricity, water, gas, mortgage/rent, food, transportation. Discretionary spending covers items like cell phones for every member of the family, cable, internet, visits to the casino, cigarettes, beer, and similar things that are not vital to your survival.

Figure out approximately what percentage of your monthly income is needed to cover each necessity and allocate a little more than that requirement to be put aside to cover each one. I suggest putting cash into envelopes labeled for each one. By putting a little more into the envelope, that will help to cover variances in income and costs. This idea is actually based on the ideas put forth in the book Profit First by Mike Michalowicz. The book is aimed at entrepreneurs trying to get their business to a profitable state, but the principles apply to personal finance, also.

They KEY thing is to not touch the money once you put it aside unless you are paying the bill it is dedicated to.

Make sure you are also able to put aside an emergency fund. The amount should be approximately three times your monthly income/take home pay. This goes a long way towards keeping your life steady in the event of bad weather, vehicle breakdown, illness, etc.

Try to stick to only spending on necessities until you are comfortably out of debt. Then start looking for ways to invest some of your “profit” to make you more money. (Since I am not a financial advisor, I can’t offer advice on how to invest that money, but I will cover my thoughts on the matter in a future post.)

Credit cards:

Only use them if you have the money to pay for what you are purchasing and can commit yourself to not spending the cash on anything other than paying your credit card bill. If you have a balance on your credit card, don’t use it at all until the balance is paid off. Only then should you use a credit card to buy stuff.

If you already have a balance on your credit card or even multiple cards, work on paying off those balances first. There are two approaches to methodology when doing this, either start paying extra on the card with the highest interest rate and balance, if you can make yourself do that regularly without getting disappointed or pick a card with the smallest balance and pay it off first. This will give you a self-esteem boost by way of accomplishment.

DON’T PUT ANYTHING ELSE ON THAT CARD!

After the first one is paid off, take the monthly allotment of your income that was dedicated to paying off that card and start adding it to what you are paying on the next card. Keep doing that until all of your cards are paid off.

PAY OFF YOUR BALANCE EVERY MONTH!

This is crucial for not accumulating debt. It may even be better for you to have a charge card like American Express, where you are required to pay it off every month.

Don’t “float” your balance from one new card to another without paying it off. It ends badly.

Psychological Reasons for Spending

We are constantly being bombarded with advertising trying to influence us to spend money. Whether it is buy a new car, get the latest phone, or use our credit card to buy your dreams. Advertising implies that if we don’t spend, we are a lesser person. Don’t believe it!

Yes, you do need some of the things you see advertised, but you don’t need to go broke or get in debt to get it.

Buying things to feel better about yourself actually make you feel worse in the long run.

DO something to change the things in your life you don’t like. Don’t waste time worrying about the things you can’t change, because it will only make you feel worse.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

REI: Kick Yourself in the Ass Gotchas

|

| Image from US Patent #6,293,874…”User-operated amusement apparatus for kicking the user’s buttocks” |

Today I am going to cover some things that we experienced last year while rehabbing a house acquired to become a rental.

This was our first acquisition, so I wanted to be thorough in analysis, planning, and execution. I had a home inspector check for problems with the house. He checked the electrical, cooling, foundation, plumbing, water heater, and roof. Issues were pointed out with the electrical, gas valves, air conditioner ductwork, and a couple of other minor things.

I brought in the following for estimates:

- An electrician to fix the issues pointed out by the inspector and to add GFCI outlets near the sinks.

- A plumber to replace supply valves & faucets in the kitchen and bathroom, gas supply valves for the stove and water heater, and to re-route the overflow drain for the water heater.

- A HVAC contractor to replace the ductwork.

- Multiple contractors to bid on the rest of the rehab stuff.

I thought I had things well covered. I was wrong. The first shock was that we had to replace the whole interior HVAC system. The furnace part was rusted through and a fire hazard. That wasn’t too bad, as we had a buffer in our budget for overages and $4,200 wasn’t going to kill it. (That price did include replacing the duct work.)

The next surprise was after the first tenants moved in, they attempted to wash clothes and the washer drain overflowed into the utility room. A phone call to the plumber and a day of trying to unclog the drain, it was determined that years ago, when the neighborhood was converted over to municipal sewerage, the original owners never bothered to tie in the utility room drain to the main drain line and just left it connected to the main field drain in the back yard, which had since collapsed, thus restricting flow and backing up into the utility room. Add another day for the plumber to route a drain through the wall and across the back patio (most likely the condemned septic tank) and tie it into the main drain line at a total cost of approximately $700.

Caveat: We will have to eventually add a full drain line underground tied into the main system.

#SilverLining: We will now have the drain necessary to convert part of the utility room to a half bath at some point, increasing the value and desirability of the property.

At one point, the original owners of the house upgraded the windows to vinyl double-paned glass. In doing so, there were gaps in between the windows and the sill in some rooms. I notice them, but in triaging everything that needed to be done, they kept falling to the bottom of the priority list. And, they never got done. Additionally, we kept finding wasps in the room where the gaps were the biggest. It seemed unrelated. The tenants actually correlated the gaps with the wasps continuously appearing in that room and asked for me to fix it. It didn’t take more than some expanding foam and caulk, but, like the other items listed here, I should have recognized the issues and fixed them prior to the tenants moving in. Total cost for the fix: about $25.

So, for the next property we purchase, I will make sure that we check all drains for restrictions, ensure all trim are sealed, and plan to continue to have the HVAC contractor evaluate the heating & cooling system. This will help to save extra work that we did not budget for and aggravation for us and the tenant in getting the issues mitigated.

If you have rental property, have you run into things like this? Let me know in the comments below.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

Real Estate Investing: Getting Scammed by a Contractor

|

| Actual picture from one of our properties. |

One of the last things you want to do is to get scammed as a real estate investor. It will happen if you are not prepared and do not have systems and processes in place to keep you from getting scammed.

Story Time

When we decided to turn my in-laws house into a rental, we started to look for contractors to do the rehab on it because I was too busy with work to do it myself (and I wasn’t that great at what was needed anyway).

We asked around on Facebook, but didn’t get a whole lot of suggestions. A friend of a relative could do some of it, but we wanted to get someone to do all of the work.

My wife heard an advertisement on a local radio station for a home improvement contractor, so we called him to get a bid. He gave us a fairly cheap bid and said he could start working immediately. We decided to use him. (Mistaken Thinking #1: Since he was advertising on the radio, he must have been a legitimate contractor.) He told us he was licensed and insured, so we believed him (See mistaken Thinking #1). He then asked for a 30% down payment to be able to purchase materials, so we paid him the down payment. (Mistaken Thinking #2: It’s OK to pay a down payment before work starts.) After six weeks of no work being done except removing the one piece of baseboard and shoe molding in the picture above, in addition to him coming to us for additional material draws (that we paid), we finally realized that he wasn’t going to do the work.

We suspected something was up after four weeks, but didn’t want to believe it. Thankfully our state has a contractor Fraud law and between our complaints and complaints of other victims from surrounding area, there was enough to arrest him. He made a plea deal and has paid back almost half of the money he owes us.

Tips for dealing with contractors:

- ALWAYS VERIFY their state-issued contractor’s license! Your state’s Contractor Licensing Board or a similar entity should have a way for you to verify that the contractor’s license is still active via a website.

- ALWAYS VERIFY their Insurance Certificate! Call the insurance company and/or agent to verify. These days, anyone can create counterfeit insurance certificates online. Their insurance protects you if one of their employees gets hurt on the job.

- Check references. You usually will be referred to contractors by other friends or investors who have used them before and can vouch for their work.

- Sign a contract that details the following: (Disclaimer-I am not a lawyer & I don’t play one on the internet…always check with your own attorney!)

- Scope of work to be performed

- When the work will start

- How long the work is expected to take

- What milestones need to be achieved, satisfactorily, to qualify for a draw

- Check on the contractor’s work frequently to ensure timely completion

We eventually found a really good contractor who came in and rehabbed everything in the house for us in about a month for a really good price. And we have been renting out the property ever since.

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

My Responses to Tim Ferriss’ “Tribe of Mentors” Questions

This week, I am going to take a swipe at answering the questions from Tim Ferriss’ book, Tribe of Mentors. These are questions distilled and honed from his interviewing many peak performers on his podcast. AND, just to be clear, Tim Ferriss did not ask me these questions. I thought they were interesting in and of themselves and decided to dedicate a post to them.

What is the book (or books) you’ve given most as a gift, and why? Or what are one to three books that have greatly influenced your life?

I haven’t really gifted many books. But I’m trying to change that. As far as books that have greatly influenced me, I have three. Rich Dad,Poor Dad by Robert Kiyosaki is a really good book for helping you to realize that what you weren’t taught in school about money can hurt you, or at the minimum, make you struggle to achieve your dreams and goals. Depending on your personality, it may rub you the wrong way, but it speaks volumes of truth about making money. The E-Myth Revisited by Michael Gerber provides excellent advice on how to systematize a business so it can run smoothly and grow. And, finally, The 4 Hour Workweek by Tim Ferriss. I really like because it provides you with principles to lead your life by. Mainly, set up a low-input business to pay for your needs, don’t kill yourself working as a trade-off for retiring at a later age, when there is a good chance that you will be too old or sickly to enjoy it. It fosters the idea of continuous “mini-retirements” throughout your life. And most importantly, with all the free time you create, do something important, do something you care about, do something to impact the world in a good way.

What purchase of $100 or less has most positively impacted your life in the last six months (or in recent memory)? My readers love specifics like brand and model, where you found it, etc.

A couple of things I’ve bought have made a positive impact…one is a set of wireless earbuds. I generally have issues with wired earbuds catching on stuff as I walk around or do work, so these are pretty neat in that they do not hang down very far past my neck. The other is a battery pack to charge my phone throughout the day. Depending on what I am doing, sometimes my phone will run down quicker than others. Having the battery pack available to boost it up is nice. Plus,it has enough power to charge the phone twice.

How has a failure, or apparent failure, set you up for later success? Do you have a “favorite failure” of yours?

I don’t really have a favorite failure,because there are too many to choose from! I have many failures, that if they would not have happened,I would not be where I am today. So I guess all of my failures are my favorites? Or better yet,the only real failure is the ones you do not learn from.

If you could have a gigantic billboard anywhere with anything on it — metaphorically speaking, getting a message out to millions or billions — what would it say and why? It could be a few words or a paragraph. (If helpful, it can be someone else’s quote: Are there any quotes you think of often or live your life by?)

If you don’t like something in your life, then do something to change it! If you can’t change it, then don’t waste time worrying about it.

What is one of the best or most worthwhile investments you’ve ever made? (Could be an investment of money, time, energy, etc.)

So far, I would have to say that the most worthwhile investment I have made is buying a door manufacturing company with some friends. To date, it has been a trying experience and has strained some of the friendships,but i have learned more about operating a business in the past 14 months than I have in most of my career working in the Oil and Gas industry.

What is an unusual habit or an absurd thing that you love?

I tend to approach ideas/tasks/goals with lots of technical detail. For example, as a group, my partners and I decided to build a tool for tracking product shipments and invoicing on a per-order basis to allow forecasting estimated revenue. I visualized a quasi-CRM system with lots of inputs that would return lots of information, but what we really needed was just a spreadsheet similar to a Gantt chart to track the information. We will eventually implement a more detailed CRM system, but I over-engineered it in my mind.

In the last five years, what new belief, behavior, or habit has most improved your life?

Two things…realizing that a lot of the decisions I made in my past were most likely influenced by my being infected by the toxoplasmosis gondii parasite, thus helping me to further screen my decisions for risk, and understanding that my outlook / philosophy on life is actually based on stoicism. I don’t know how I arrived at that outlook, but it just made sense to me. Learning more about it has definitely improved how I view the world.

What advice would you give to a smart, driven college student about to enter the “real world”? What advice should they ignore?

Don’t fall into the mindset trap of working most of your life, toiling away to reach retirement. Work for yourself. Resolve to mostly buy “assets”, things that will provide you with cash flow.

What are bad recommendations you hear in your profession or area of expertise?

From the oil and gas industry: “Drill the well faster so we can finish faster!” In most cases, you can drill faster than you are able to transport the drilled cuttings out of the hole. It is better to drill at a sustainable rate and have no trouble pulling out of the hole or running casing, thus decreasing overall time spent on the section.

In the last five years, what have you become better at saying no to (distractions, invitations, etc.)? What new realizations and/or approaches helped? Any other tips?

I manage automated equipment and services operations and have done so for the last six years or so. Initially, whenever there were problems, I would access things remotely and resolve the issues, many times at all hours of the day or night. Then the next issue came along,and I would have to solve it also. I realized that if I stopped swooping in to save the day, the employees would be more inclined to solve the issue themselves. This has helped me to keep from feeling overwhelmed. I sleep a lot better now.

When you feel overwhelmed or unfocused, or have lost your focus temporarily, what do you do? (If helpful: What questions do you ask yourself?)

First, I have learned to say “no” to things. Second, I found that if I use Noisli, I am more relaxed and can focus on the task at hand. Plus it helps to block out unwanted noises and distractions.

I hope you like my “Tribe of Mentors” Q&A responses!

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

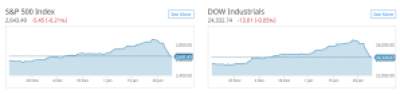

So the Stock Market Dropped a Little…

|

| The bottom, so far, is still higher than where we were in November. |

There was a significant drop-off last week through yesterday in the US stock market. The possible good news is that after a few straight days of dropping, today it looks to be climbing again. And the markets seem to have only dropped to early December levels. It’s the market, that’s what it does.

The purpose of this post is to document an observation. My inbox is starting to fill up with email from various advisory services, both automated web-based and actual human-led “capital management” firms to plug their services in these “times of uncertainty”.

I get it. They are taking advantage of a marketing opportunity when a certain segment of the population in the US will get worried that their retirement or investment dollars could be at risk. It just seems a little icky.

\rant

Real Estate Investing: How We Started Out

|

| Like the game Monopoly, you can grow your money with Real Estate. |

This week, we are going to talk about how we started investing in real estate. It wasn’t an overnight decision, or result, for that matter.

My first foray into real estate investing (REI) was to partner with one my uncles and my cousin (his son) to develop an RV park in the Port Fourchon area. It seemed like a great idea…lots of potential for revenue and extended development. And I knew nothing about evaluating the deal to see if it was going to be a money maker or not. I put up the money to initiate the lease of the land ($20,000) and we proceeded to get a loan from a local bank to develop the park. We had to get permits, evaluations, inspections, etc. The total amount from the bank came to $150,000. Just as the park was about to open, the BP Macondo/Deepwater Horizon oil spill happened and shut down the oil & gas industry in the Gulf of Mexico. The space was leased to a catering company as a staging area for feeding spill cleanup workers and to facilitate a training space.

We eventually opened up the park and began operating. My cousin and his wife managed the operations.

I began traveling around the world a good bit for work and realized that I could not be deeply involved in the deal in addition to my wife not being happy with me involving us in it in the first place. My cousin offered to buy us out for $30,000, paid over time. This worked for us as it got our money back, along with about a 17% total ROI.

While the deal made us money, the stress and aggravation of not being in control left us with a bad taste in our mouths.

Fast forward a couple of years and we decided to remodel my in-laws’ home to set up as a rental. My father-in-law passed away the preceding year, leaving the home to my wife. We got it remodeled after a few false starts and bumps in the road. And started renting it out.

I mostly stayed hands-off of the operations and mainly just helped handle repairs & stuff, since it was my wife’s house (via inheritance).

Towards the end of 2015, I started to get aggravated with my job, (for the nth time), and started a more serious search for something else that I could rely on for income. In January of 2016, I found Bigger Pockets, an online forum/educational platform for real estate investors. It was then that I realized that REI was something that I could do. In fact, in a way, we were already doing it. The thing that appealed to me about it was that successful investors rely on systems and processes to make their businesses run well. WOW! I am a “Systems & Processes” type of guy! It was an epiphany, of sorts.

I started listening to podcasts, devouring forum posts related to my topics of interest, attending real estate investor association meetings, and reading books to learn about how to reach my financial goals through REI. I put together a 30,000 foot overview of what I would like to do and how I could do it. When I discussed my idea with my wife, she was initially skeptical because I repeatedly come up with plans to make money and either never initiate them or follow through on them.

I continued to learn about buying and managing rental properties, along with operating a business. I became more involved in the operation of the existing rental, more or less making it my responsibility.

So, that is how we got started in REI.

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

On Achieving Goals or How Much Is Enough

|

| “Everything we see hides another thing, we always want to see what is hidden by what we see.” -René Magritte |

What is your goal with regards to financial stability? Do you want to be “a millionaire”? Do you want to be considered one of the richest people in the world? Do you want to retire early and follow a passion, such as world travel or support a volunteer organization?

Or do you just want to get to the point of being able to live comfortably and not have to worry about worrying? (FYI, these are not rhetorical questions. I really would like to know your goals)

There seem to be several ways of looking at this and all seem to contradict each other in some way, shape, or form.

Having the goal of becoming “a millionaire” is either not a good idea (according to CNBC) or highly dependant on your goals and specific situation (according to Kiplingers). TL;DR – Lot’s of factors to consider.

If becoming one of the richest people in the world is your goal, there is a pretty good chance that you already are there. If you make more than $34, 200 per year in income, you are already in the top 1% of the world’s wealthy. If you are looking at Net Worth, you need to have a Net Worth of $770,000 or better to be in the top one percent of the wealthiest people in the world.

For those of you who want to retire early for travel or whatever, it is possible with a little effort and strategic thinking. Or, better yet, take the Tim Ferriss approach and set yourself up to take multiple mini-retirements starting now.

I kind of like the Tim Ferris approach and want to achieve that one day. And we are working towards that goal. In fact, I would venture to say that we are almost there.

I have worked most of my life with the goal of getting to this goal or that goal, then everything will be: easier, gravy, much simpler. But this past year, we had a revelation…over the last 15 years or so, every change in situation at work or uncomfortable conditions to be endured were rationalized by saying “this is only temporary and when I achieve “X”, things will be much better!” The revelation was that every time “X” was achieved, a new “X” would take it’s place. It’s a continual cycle of expanding goals.

Not long after realizing that this was continually happening in my work life, a speaker at a REIA (Real Estate Investment Association) that I attend in Lafayette, Louisiana covered the topic “Freedom Number?…Check! Now What? Albert Pellissier basically pointed out that you don’t need to be on a continuous roller coaster of “Striving for ‘X'” and spend more time with your family, enjoying your life.

That is what I intend to do. I also want to share tips, tricks, and ideas, through this blog, with all of you, to help you achieve your goals.

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.

My History With Money, Pt. II

- Learning to not spend, especially when I don’t have it

- Learning to not spend just because I have it

My History With Money, Pt. I

|

| What I grew up seeing around me. |

|

| What I wanted to do. |

Today I am going to relate my experiences with Money from when I was a child to present day, in a loose chronological order.

My parents split up when I was approximately 10 years old and I don’t really remember a whole lot about our finances prior to that. What I do remember is that after that point, things were not easy.

We moved in with my grandparents, away from friends and family, started a new school, and began a different life. At the end of that school year, I began an unwanted tradition of working every summer on one of my grandfather’s shrimp boats and later in my uncles’ seafood businesses. Whatever money was earned went to help cover costs for my mother, my sister, and me to survive. I would get a hundred dollars at the end of the summer to buy school clothes for the upcoming year and that was the about all I would see of what I made.

My cousins of a similar age were doing the same work as me, but they got to keep all of their money, spending it on nice stereos, toys, etc., because their parents were making money and running a business.

I started learning about the businesses because it seemed like the way to not be poor. What I learned, besides the mechanics of actual operations, were bad money management habits.

Things seemed to be all about making sure you got your share out of the revenue, to the detriment of everything else…spending the holidays at hunting camps, spending the last bit of money you have, with no guarantee of future revenue.

This is not a good model to follow, especially if you are trying to maintain a steady income, much less, grow your income. Eventually, within a few years, both uncles were out of money, with no business to support them, because they only focused on the “right now” and had trouble planning for the long haul.

The takeaway lesson from today’s post is to not spend everything you make. Practice restraint and plan for the future. Short of winning the lottery like a former co-worker, you will not get rich quick. BUT, if you practice this as a habit, it should allow you to prepare for retirement.

Let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.