|

| Our Second Rental Property! |

This week we are going to talk about how we found our second real estate investment property. If you have been playing along, you know that our first property was my wife’s inherited childhood home that we turned into a rental.

Because I work a full-time (+) job in addition to being a minority shareholder & director of a manufacturing business, I don’t have a marketing pipeline set up to find properties. That doesn’t mean I won’t ever have one, just that right now I am moving slowly. Mainly, my wife and I watch the MLS (via Zillow, Trulia, Realtor.com, and local real estate companies) for properties that fit our criteria. That criteria is three bedroom, two bathroom houses built on a slab foundation with central heating and cooling in decent neighborhoods. We have more or less decided to focus on the Thibodaux, La area, mainly because I am very familiar with Thibodaux and Nicholls State University is located there.

We noticed a price drop for a property just outside of the city limits of Thibodaux. It is about a 5-minute drive from the university. Initially, the property was listed at $120,000. I thought that was a little high for us to buy as an investment, so I did not pay much attention to it. The price drop was $40,000, so that was enough incentive for us to go check out the property.

In looking at the pictures on Zillow, I recognized the name of the listing agent from the sign in the yard. It was the same agent that acted as property manager when I was renting a house a block or so away from the subject property some twenty plus years ago. So, I emailed her to ask about a showing. We were able to go look at it and liked the structure. While there were some superficial repairs and painting needed, structurally, it was in good shape. We estimated that we could rehab it for approximately $20,000, with a $5,000 contingency budget in case we needed to do anything else.

Below are before pictures. More of the story after that.

We put in an offer of $72,581. It was accepted and had 10 days from their acceptance to perform due diligence on the property. We immediately lined up an inspection by our HVAC contractor and a certified home inspector, in addition to requesting an estimate from an electrical contractor.

The home inspector identified some issues with the electrical panel & feed lines and confirmed that the water damage to the ceiling tile was due to the air conditioning duct work sweating and leaking through.

The HVAC contractor identified that the furnace chamber had rusted out and the whole inside unit needed to be replaced. We had the option to replace the inside portion for $4,200 or the whole system for $5,700. If he would have to come back to replace the outside portion, it would be $2,000. We decided to wait on replacing the outside unit in the hopes that we could get another 2-3 years out of it. #ThereWentTheContingency

The electrical estimate came back at just under $2,000 to install GFCI outlets by the kitchen and bathroom sinks and to repair the panel/feed line issues, with $1,500 of it accounting for the panel/feed line issues.

I mentioned this fact to the real estate agent, who then got back with the seller and they responded with a counter offer of $71,000 for the home, basically negating the cost of repairing the panel/feed lines.

Next, I lined up a title company to close the transaction. Because the property was owned by 9 surviving heirs, it took a while for claims against the title to be researched. In addition to that, closing was delayed because one of the heirs owed child support and we had to get the district attorney to sign off on allowing the sale, as long as that heir’s proceeds were directed to monies owed.

We finally closed and began to work on the rehab. While waiting for closing, we identified a general contractor to change out doors, hang & finish drywall, and lay down new flooring and trim, among other things.

We handled painting, lighting fixtures, trim in the kitchen, and plumbing. The contractor handled everything else. It took us about 3 and a half months to finish everything and another 2 months to find the right tenants.

There were a couple of things that needed to be fixed after the tenants moved in, but it has now been six months since the lease started and everything is running smooth. The tenants are under a two year lease, so we have locked in cash flow through Q3 2019 for the property.

Because we purchased all cash, we have no debt service expenses. We may look at refinancing the property in the future, but I like the idea of cash flow because my goal is to get to the point where I can live just off of cash flow.

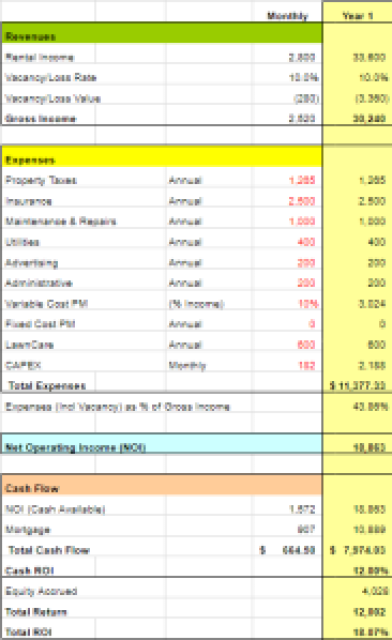

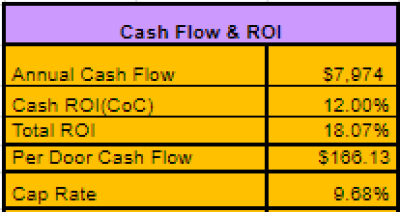

Numbers Breakdown

Purchase Price – $71,000

Rehab Costs – $20,637

ARV (After Repair Value) – $130,000

Annual Gross Rents – $11,100

CoC (Cash on Cash Return) – 5.38%

ROI – (Return on Investment) – 5.38%

Expenses – $4949

NOI – $5041

Debt Service – $0

Cash Flow-Annual – $5,041.22

Cash Flow-Monthly – $420.10

Cash Flow/Door-Monthly – $420.10

After pictures below:

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.