Do you ever get to a point where you are feeling overwhelmed with everything going on in your life? The constant demand from work, the building up of lots of meaningless little things that put you in a funk? Or what about a sudden realization that things in your life that you took for granted are no longer a sure thing?

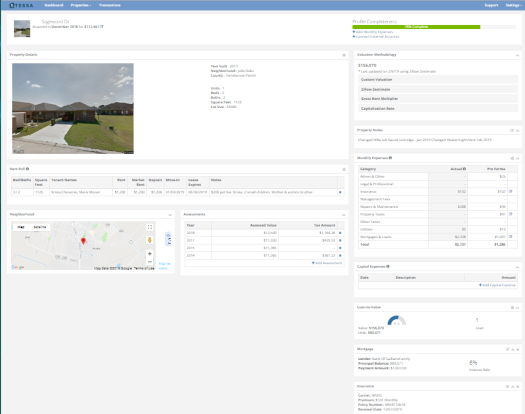

Click on this link to get your own free copy of the Rental Property Tax Guide by Stessa.

Well, that has been me for the last few months. I believe it started with my health. As I talked about in a previous post, I was diagnosed with thyroid cancer. And luckily, it was the easily treatable, slow growing kind. Simple solution. Remove the thyroid gland, check for any other abnormalities near it, and carry on.

Or at least so I thought. The surgery was quick and without complications. No abnormalities observed in the surrounding tissues, most likely due to such an early diagnosis. When the pathology came back saying that there was a third tumor growing on the other side of my thyroid gland, my endocrinologist decided to ablate me with radioactive iodine. This would kill the remaining thyroid cells and virtually eliminate any chance of thyroid cancer coming back.

Because he suspected that we might have to go that route, he did not start me on replacement thyroid hormone medications, choosing to wait until a decision was made on the radioactive iodine (RAI). I felt fine right up until I did the RAI. This was approximately 6 weeks post-surgery, which is also just about the length of time that thyroid hormones live in your body. What that means is that I had little to no energy and mostly just sat around.

I was able to start the meds a couple of days after the RAI and I began to feel better. Over the next few weeks the doctor ramped up the dosages, trying to get my hormone numbers in line. And it worked/is working. BUT, I have nowhere near the endurance I used to. I normally get up around 05:00, give or take. But by 17:00 – 18:00 in the day, I had no more energy. Now I am able to last to about 20:00, then it is sit or lay around and nothing strenuous.

So that was bad enough, but on top of that, my glucose levels have begun to go a little haywire. I can have normal numbers throughout the day (120 – 150) & low levels at night (45 – 68), then wake up in the morning to levels at 245 -280.

The doctor thinks that it may stabilize once we balance my thyroid hormone levels. It also may be related to a medication change made a few months ago.

In addition to the medical issues, there has been a lot of stress at work, which probably magnifies all of my medical issues.

With all of this going on, I did not feel like doing much of anything extra-curricular. I had a realization that this was my new normal. There would be no more “go, go, go” and rest on the weekends.

I was depressed.

Now I don’t claim to have a solution for depression, I am only relating what I am observing.

We took the kids to see Weird Al Yankovic in concert in New Orleans, that seemed to help. And this week, I had to travel to Dallas to present at a workshop for a different group in the company for my job. While there, I had dinner with a buddy I hadn’t seen in twenty-plus years. IT was good to catch up with him. On top of that, I started to listen to music a little more. My aural diet has been mostly podcasts and audiobooks for the last three or four years, so music is a refreshing change, in addition to being therapy for my soul.

So, what I suggest to you, dear reader, is that if you find yourself in a similar situation, don’t wait to do some self-therapy…find what feeds your soul. Take Care of Yourself.

Do you have single family or small multi-family rental properties and need to insure them? Are you a flipper in need of a rehab policy? Visit National Real Estate Insurance Group. Great rates. Coverages you need. Commercial Liability. Monthly Payments, No Financing. Add/Remove Properties as Needed.

And, as always, let me know what you think in the comments. Ask questions, tell your story.

If you like my posts, please share them with others and subscribe to this blog.